Go Back

Last Updated :

Last Updated :

Dec 6, 2025

Dec 6, 2025

How Strategic Bookkeeping Strengthens Hospitality Operations

For founders steering hospitality businesses, bookkeeping for hospitality is more than just crunching numbers—it's the backbone of managing revenue and optimizing operations. Whether you run a boutique hotel, a restaurant chain, or a catered events service, your financial records must precisely reflect every transaction, enabling strategic decisions that foster growth and stability.

In this guide, we'll break down practical bookkeeping approaches tailored for hospitality, highlight key financial management tasks, and explain how modern, founder-friendly services like Haven can simplify your accounting. This way, you can focus on delivering memorable guest experiences while keeping your business financially healthy.

Why Bookkeeping for Hospitality is a Unique Challenge

Unlike many other industries, hospitality revenue fluctuates daily based on occupancy rates, seasonal demand, and events. Expenses are equally varied—ranging from food and beverage costs to labor, maintenance, and marketing. This dynamic environment requires a bookkeeping system that captures granular transaction details while providing snapshot insights into cash flow and profitability.

Key complexities in hospitality bookkeeping include:

Multi-channel revenue streams: On-premise dining, room bookings, event hosting, merchandise, and delivery services.

Inventory management: Tracking perishable goods and supplies with tight margins.

Labor and payroll accounting: Scheduling and tip reporting across shifts.

Sales tax compliance: Different tax rates on food, beverages, and lodging.

Vendor and supplier payments: Managing invoices for diverse services.

Ignoring these variables can quickly turn a profitable month into a cash flow crisis. Founders who correctly interpret their financials can make smarter, faster calls on pricing, staffing, and procurement—key levers in a successful hospitality business.

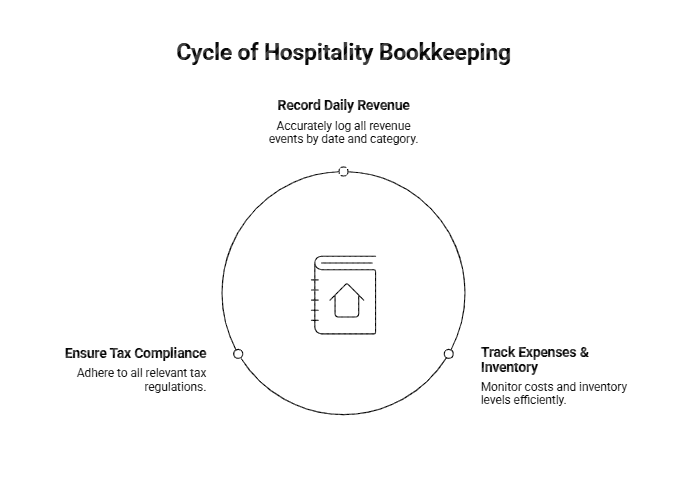

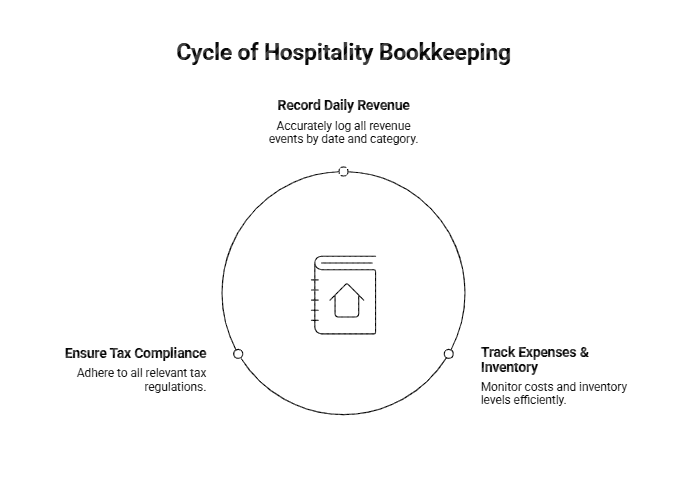

3 Core Components of Bookkeeping for Hospitality

1. Accurate Daily Revenue Recording

The first priority is to record every revenue event by date and category.

Best practices include:

Integrate your POS and reservation systems with your bookkeeping software to sync sales data automatically.

Categorize revenue streams (e.g., room sales, food sales, events).

Reconcile daily sales reports with bank deposits to detect discrepancies.

2. Expense Tracking and Inventory Control

Tracking costs in inventory, payroll, repairs, and supplies requires discipline and system integration.

Key techniques:

Use inventory management tools to log usage, waste, and reorder timing.

Record vendor invoices promptly and categorize expenses accurately.

Integrate timesheets or scheduling tools with payroll to maintain real-time labor cost visibility.

3. Compliance with Hospitality Tax Regulations

Sales and lodging taxes require careful attention.

Founders should:

Stay current with local and state-specific tax rules.

Collect and report taxes accurately using dedicated accounting codes.

Use automated tax calculation tools embedded in POS or bookkeeping systems.

Using Bookkeeping Insights to Drive Hospitality Operations

Hospitality businesses operate on thin margins, fast-changing demand cycles, and high operational complexity. Effective bookkeeping doesn’t just document transactions — it produces insights that shape pricing, staffing, inventory planning, and cash flow decisions. The table below highlights how financial data translates into practical operational actions across core areas of a hospitality business.

Operational Aspect | How Bookkeeping Helps | Example Action |

Pricing Strategy | Analyzes revenue by category and season | Adjust menu pricing during low-margin time periods |

Labor Management | Tracks labor cost vs. revenue | Optimize scheduling during peak vs. slow hours |

Inventory Control | Monitors usage rates and vendor spending | Cut waste or renegotiate supplier contracts |

Cash Flow Forecasting | Predicts upcoming expenses and revenue | Plan for slow seasons or large vendor payments |

Compliance Risk | Ensures correct tax tracking | Reduce audit risk with proper occupancy and sales tax reporting |

When these financial signals are reviewed consistently, they give founders a clearer understanding of where profit is created or lost. Whether it’s refining menu pricing, managing labor loads, controlling suppliers, or planning for seasonal shifts, bookkeeping insights help hospitality operators stay agile and make decisions grounded in real performance patterns — not guesswork.

Getting Started: Tips for Effective Hospitality Bookkeeping

Choose scalable bookkeeping software that integrates with your POS system.

Reconcile daily to ensure accuracy across deposits and recorded sales.

Track payroll meticulously, including shift logs and tip reporting.

Separate personal and business finances to simplify tax preparation.

Review reports regularly—weekly or monthly—to catch trends early.

These habits help hospitality founders maintain profitability and prevent issues before they grow.

How Haven Supports Bookkeeping for Hospitality Founders

Haven offers startup-native bookkeeping tailored to hospitality businesses, helping you automate daily financial tasks and stay compliant.

Founder-Focused Benefits:

Streamlined system integration: POS, payroll, and inventory tools connected into one unified bookkeeping flow.

Real-time financial dashboards: Clear views of expenses, margins, and cash flow.

Dedicated bookkeeping experts: Proactive financial insights, not just reconciliations.

Specialized tax compliance: Sales tax, lodging tax, payroll tax, and industry-specific filings.

Flexible, founder-friendly pricing: Explore our services and pricing.

By trusting Haven with your books, you can stay hands-on with guests and operations—without losing visibility into your financial health.

Turning Financial Clarity Into Operational Strength

For founders navigating the hospitality sector, effective bookkeeping for hospitality is a strategic asset—not just a back-office obligation. It supports profitability, operational efficiency, and sustained growth.

At Haven, we specialize in bookkeeping for startups, agencies, and hospitality businesses with modern systems and expert support. If you’re ready to streamline your finances and stay compliant:

For authoritative industry-specific compliance information, refer to the IRS’s official resource on Hospitality Tax Requirements.

For founders steering hospitality businesses, bookkeeping for hospitality is more than just crunching numbers—it's the backbone of managing revenue and optimizing operations. Whether you run a boutique hotel, a restaurant chain, or a catered events service, your financial records must precisely reflect every transaction, enabling strategic decisions that foster growth and stability.

In this guide, we'll break down practical bookkeeping approaches tailored for hospitality, highlight key financial management tasks, and explain how modern, founder-friendly services like Haven can simplify your accounting. This way, you can focus on delivering memorable guest experiences while keeping your business financially healthy.

Why Bookkeeping for Hospitality is a Unique Challenge

Unlike many other industries, hospitality revenue fluctuates daily based on occupancy rates, seasonal demand, and events. Expenses are equally varied—ranging from food and beverage costs to labor, maintenance, and marketing. This dynamic environment requires a bookkeeping system that captures granular transaction details while providing snapshot insights into cash flow and profitability.

Key complexities in hospitality bookkeeping include:

Multi-channel revenue streams: On-premise dining, room bookings, event hosting, merchandise, and delivery services.

Inventory management: Tracking perishable goods and supplies with tight margins.

Labor and payroll accounting: Scheduling and tip reporting across shifts.

Sales tax compliance: Different tax rates on food, beverages, and lodging.

Vendor and supplier payments: Managing invoices for diverse services.

Ignoring these variables can quickly turn a profitable month into a cash flow crisis. Founders who correctly interpret their financials can make smarter, faster calls on pricing, staffing, and procurement—key levers in a successful hospitality business.

3 Core Components of Bookkeeping for Hospitality

1. Accurate Daily Revenue Recording

The first priority is to record every revenue event by date and category.

Best practices include:

Integrate your POS and reservation systems with your bookkeeping software to sync sales data automatically.

Categorize revenue streams (e.g., room sales, food sales, events).

Reconcile daily sales reports with bank deposits to detect discrepancies.

2. Expense Tracking and Inventory Control

Tracking costs in inventory, payroll, repairs, and supplies requires discipline and system integration.

Key techniques:

Use inventory management tools to log usage, waste, and reorder timing.

Record vendor invoices promptly and categorize expenses accurately.

Integrate timesheets or scheduling tools with payroll to maintain real-time labor cost visibility.

3. Compliance with Hospitality Tax Regulations

Sales and lodging taxes require careful attention.

Founders should:

Stay current with local and state-specific tax rules.

Collect and report taxes accurately using dedicated accounting codes.

Use automated tax calculation tools embedded in POS or bookkeeping systems.

Using Bookkeeping Insights to Drive Hospitality Operations

Hospitality businesses operate on thin margins, fast-changing demand cycles, and high operational complexity. Effective bookkeeping doesn’t just document transactions — it produces insights that shape pricing, staffing, inventory planning, and cash flow decisions. The table below highlights how financial data translates into practical operational actions across core areas of a hospitality business.

Operational Aspect | How Bookkeeping Helps | Example Action |

Pricing Strategy | Analyzes revenue by category and season | Adjust menu pricing during low-margin time periods |

Labor Management | Tracks labor cost vs. revenue | Optimize scheduling during peak vs. slow hours |

Inventory Control | Monitors usage rates and vendor spending | Cut waste or renegotiate supplier contracts |

Cash Flow Forecasting | Predicts upcoming expenses and revenue | Plan for slow seasons or large vendor payments |

Compliance Risk | Ensures correct tax tracking | Reduce audit risk with proper occupancy and sales tax reporting |

When these financial signals are reviewed consistently, they give founders a clearer understanding of where profit is created or lost. Whether it’s refining menu pricing, managing labor loads, controlling suppliers, or planning for seasonal shifts, bookkeeping insights help hospitality operators stay agile and make decisions grounded in real performance patterns — not guesswork.

Getting Started: Tips for Effective Hospitality Bookkeeping

Choose scalable bookkeeping software that integrates with your POS system.

Reconcile daily to ensure accuracy across deposits and recorded sales.

Track payroll meticulously, including shift logs and tip reporting.

Separate personal and business finances to simplify tax preparation.

Review reports regularly—weekly or monthly—to catch trends early.

These habits help hospitality founders maintain profitability and prevent issues before they grow.

How Haven Supports Bookkeeping for Hospitality Founders

Haven offers startup-native bookkeeping tailored to hospitality businesses, helping you automate daily financial tasks and stay compliant.

Founder-Focused Benefits:

Streamlined system integration: POS, payroll, and inventory tools connected into one unified bookkeeping flow.

Real-time financial dashboards: Clear views of expenses, margins, and cash flow.

Dedicated bookkeeping experts: Proactive financial insights, not just reconciliations.

Specialized tax compliance: Sales tax, lodging tax, payroll tax, and industry-specific filings.

Flexible, founder-friendly pricing: Explore our services and pricing.

By trusting Haven with your books, you can stay hands-on with guests and operations—without losing visibility into your financial health.

Turning Financial Clarity Into Operational Strength

For founders navigating the hospitality sector, effective bookkeeping for hospitality is a strategic asset—not just a back-office obligation. It supports profitability, operational efficiency, and sustained growth.

At Haven, we specialize in bookkeeping for startups, agencies, and hospitality businesses with modern systems and expert support. If you’re ready to streamline your finances and stay compliant:

For authoritative industry-specific compliance information, refer to the IRS’s official resource on Hospitality Tax Requirements.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026