Go Back

Last Updated :

Last Updated :

Dec 17, 2025

Dec 17, 2025

Bookkeeping for Chiropractors: Gain Financial Clarity, Control, and Confidence

For chiropractors building or scaling their practice, bookkeeping for chiropractors is a foundational discipline that directly affects profitability, cash flow, and decision-making. Yet many healthcare practitioners find themselves caught between providing excellent patient care and managing their financial record-keeping effectively.

By understanding bookkeeping basics tailored to chiropractic clinics, founders and operators of such practices can streamline workflows, avoid costly mistakes, and ensure compliance with tax and reporting obligations — ultimately providing peace of mind and freeing time to grow the business.

Why Bookkeeping Is Critical for Chiropractors

In a service-based healthcare business like chiropractic care, operational success hinges not just on clinical expertise but also healthy financial management. Bookkeeping serves as the backbone of that financial oversight.

Here are key reasons bookkeeping for chiropractors matters:

Cash flow management: Tracking income (from patient visits, insurance reimbursements, retail product sales) and expenses (staff salaries, rent, supplies) allows you to forecast and manage liquidity accurately. This is vital for avoiding surprises like delayed payroll or missed vendor payments.

Profitability insights: Reliable financial records help you identify which services or locations are most profitable and whether your pricing covers costs with healthy margins.

Regulatory compliance: Proper bookkeeping supports accurate business tax filings and adherence to health industry regulations, including IRS accounting requirements.

Efficient audits and loan applications: Well-organized financial statements and tracked receipts reduce time spent during tax audits or securing financing for expansion.

Supporting operational decisions: Data-driven insights via bookkeeping enable better budgeting, hiring, equipment procurement, and identifying areas for cost savings.

Core Bookkeeping Practices Tailored for Chiropractic Practices

Chiropractic offices operate differently than many other service businesses, requiring bookkeeping procedures customized for their revenue streams and expense types. Here’s a practical breakdown of the essentials:

Set Up a Dedicated Business Bank Account and Payment Systems

Separating personal and business finances is fundamental. Establish a dedicated bank account exclusively for your practice’s income and expenses. This reduces errors and simplifies bookkeeping reconciliation.

Also, implement modern point-of-sale (POS) software and patient billing systems that integrate with your bookkeeping platform. This ensures seamless capturing of payments, insurance reimbursements, and patient co-pays.

Accurately Categorize Revenue Streams

Chiropractic revenues come from multiple sources:

Patient fees for adjustments and therapies

Insurance reimbursements (private plans and Medicare/Medicaid)

Sales of supplements and wellness products

Additional services like massage or physical therapy referrals

Create clear income categories for each stream in your accounting system. This enables more precise profit analysis by service line and supports payer compliance.

Track and Categorize All Expenses Carefully

Typical expense categories for chiropractors include:

Expense Category | Description |

Rent or Mortgage | Payments for office space |

Payroll and Benefits | Salaries, bonuses, benefits for staff |

Medical Supplies | Chiropractic tables, braces, needles |

Office Supplies | Paper, printer ink, software licenses |

Marketing and Advertising | Website, referral programs, local ads |

Professional Fees | Licensing, insurance, membership dues |

Utilities | Electricity, internet, phone |

Continuing Education | Seminars, certifications, courses for staff |

Accurately documenting these costs strengthens your expense reports and supports eligible tax deductions.

Maintain Organized Documentation

Keep digital or paper copies of every invoice, receipt, and insurance claim remittance. Cloud-based bookkeeping software often allows storing attachments linked directly to transactions. This is invaluable during tax preparation or in response to any IRS audit.

Perform Regular Reconciliation and Reporting

Weekly or monthly bank reconciliations ensure that your recorded transactions match actual bank activity. This prevents financial surprises and ensures ongoing accuracy.

Regularly generate and analyze key financial statements:

Profit and Loss (Income Statement)

Balance Sheet

Cash Flow Statement

Consistently reviewing these reports can help you spot trends, control spending, and plan for growth.

Tax Considerations for Chiropractors

Solid bookkeeping goes hand-in-hand with fulfilling your tax obligations and optimizing deductions. Here’s what every chiropractic founder should account for:

Choosing the Right Business Structure

Whether your practice operates as a sole proprietorship, LLC, S-corp, or partnership affects your tax filings. Each has different implications for income tax, self-employment tax, and bookkeeping practices. A qualified tax advisor can help assess what works best, and resources like the SBA’s business structure guide offer helpful insights.

Ensure You Take Qualified Deductions

Chiropractors should explore these common deductible expenses:

Office lease or mortgage interest

Equipment depreciation (e.g., adjusting tables, diagnostic tools)

Health insurance premiums (if self-employed)

Continuing education and licensing costs

Professional memberships and business insurance

These deductions rely on precise, categorized financial records — underscoring why strong bookkeeping matters.

Monitor Sales Tax on Retail Products

If your practice sells supplements or health products, stay current with sales tax collection and reporting for your state. Unpaid sales tax can lead to compliance trouble and penalties.

File and Pay Taxes On Time

Set reminders or use integrated software to track all filing deadlines (quarterly estimates, payroll filings, annual returns). Staying proactive avoids last-minute stress and fines.

You can refer to detailed IRS guidance on business recordkeeping to ensure your chiropractic practice stays compliant.

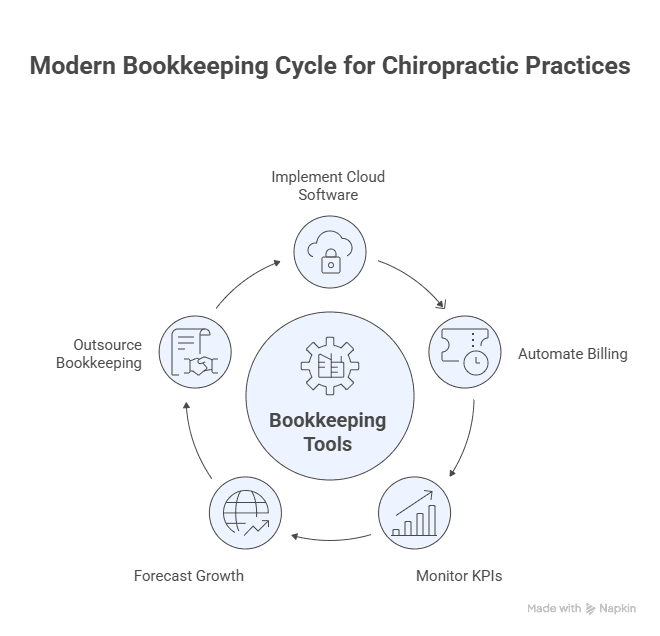

Using Modern Bookkeeping Tools to Drive Growth

Leveraging technology doesn’t just save time — it enables smarter decisions and business scale. Today’s chiropractic practices have more financial tools at their disposal than ever before:

Cloud-Based Accounting Software

Platforms like QuickBooks Online and Xero allow secure access, automated syncing with bank accounts, and real-time collaboration with your bookkeeper.

Automated Patient Billing

Use systems that integrate with your charting and EHR software to generate invoices, track receivables, and send payment reminders without manual follow-ups.

Financial KPIs and Dashboards

Gain visibility into important benchmarks:

Patient acquisition cost

Average revenue per visit

Staff costs as a percent of revenue

Customizable dashboards give founders a pulse on daily and monthly operations.

Forecasting and Scenario Planning

Model different growth paths: expanding into new locations, hiring staff, or adding services like massage therapy. Financial software can simulate outcomes based on historical data.

Outsourcing for Higher ROI

Rather than managing financials piecemeal or juggling DIY spreadsheets, chiropractors benefit from working with specialized providers. Haven’s pricing plans offer bookkeeping tailored to growing practices: accessible support, transparent pricing, and chiropractic-focused financial processes.

Confident Bookkeeping for Chiropractic Practice Success

For founders and operators of chiropractic practices, mastering bookkeeping for chiropractors is not just about compliance but about gaining clarity and control over the financial health of their business. Accurate categorization, diligent documentation, regular reconciliations, and leveraging modern bookkeeping technology transform an often-overwhelming task into a strategic asset that boosts profitability and scalability.

Haven specializes in supporting healthcare founders through comprehensive bookkeeping, tax filing, and R&D credit expertise designed for fast-growing practices. By partnering with Haven, chiropractors can enjoy peace of mind and actionable financial insights tailored to their unique business model, enabling them to focus on delivering outstanding patient care.

For chiropractors building or scaling their practice, bookkeeping for chiropractors is a foundational discipline that directly affects profitability, cash flow, and decision-making. Yet many healthcare practitioners find themselves caught between providing excellent patient care and managing their financial record-keeping effectively.

By understanding bookkeeping basics tailored to chiropractic clinics, founders and operators of such practices can streamline workflows, avoid costly mistakes, and ensure compliance with tax and reporting obligations — ultimately providing peace of mind and freeing time to grow the business.

Why Bookkeeping Is Critical for Chiropractors

In a service-based healthcare business like chiropractic care, operational success hinges not just on clinical expertise but also healthy financial management. Bookkeeping serves as the backbone of that financial oversight.

Here are key reasons bookkeeping for chiropractors matters:

Cash flow management: Tracking income (from patient visits, insurance reimbursements, retail product sales) and expenses (staff salaries, rent, supplies) allows you to forecast and manage liquidity accurately. This is vital for avoiding surprises like delayed payroll or missed vendor payments.

Profitability insights: Reliable financial records help you identify which services or locations are most profitable and whether your pricing covers costs with healthy margins.

Regulatory compliance: Proper bookkeeping supports accurate business tax filings and adherence to health industry regulations, including IRS accounting requirements.

Efficient audits and loan applications: Well-organized financial statements and tracked receipts reduce time spent during tax audits or securing financing for expansion.

Supporting operational decisions: Data-driven insights via bookkeeping enable better budgeting, hiring, equipment procurement, and identifying areas for cost savings.

Core Bookkeeping Practices Tailored for Chiropractic Practices

Chiropractic offices operate differently than many other service businesses, requiring bookkeeping procedures customized for their revenue streams and expense types. Here’s a practical breakdown of the essentials:

Set Up a Dedicated Business Bank Account and Payment Systems

Separating personal and business finances is fundamental. Establish a dedicated bank account exclusively for your practice’s income and expenses. This reduces errors and simplifies bookkeeping reconciliation.

Also, implement modern point-of-sale (POS) software and patient billing systems that integrate with your bookkeeping platform. This ensures seamless capturing of payments, insurance reimbursements, and patient co-pays.

Accurately Categorize Revenue Streams

Chiropractic revenues come from multiple sources:

Patient fees for adjustments and therapies

Insurance reimbursements (private plans and Medicare/Medicaid)

Sales of supplements and wellness products

Additional services like massage or physical therapy referrals

Create clear income categories for each stream in your accounting system. This enables more precise profit analysis by service line and supports payer compliance.

Track and Categorize All Expenses Carefully

Typical expense categories for chiropractors include:

Expense Category | Description |

Rent or Mortgage | Payments for office space |

Payroll and Benefits | Salaries, bonuses, benefits for staff |

Medical Supplies | Chiropractic tables, braces, needles |

Office Supplies | Paper, printer ink, software licenses |

Marketing and Advertising | Website, referral programs, local ads |

Professional Fees | Licensing, insurance, membership dues |

Utilities | Electricity, internet, phone |

Continuing Education | Seminars, certifications, courses for staff |

Accurately documenting these costs strengthens your expense reports and supports eligible tax deductions.

Maintain Organized Documentation

Keep digital or paper copies of every invoice, receipt, and insurance claim remittance. Cloud-based bookkeeping software often allows storing attachments linked directly to transactions. This is invaluable during tax preparation or in response to any IRS audit.

Perform Regular Reconciliation and Reporting

Weekly or monthly bank reconciliations ensure that your recorded transactions match actual bank activity. This prevents financial surprises and ensures ongoing accuracy.

Regularly generate and analyze key financial statements:

Profit and Loss (Income Statement)

Balance Sheet

Cash Flow Statement

Consistently reviewing these reports can help you spot trends, control spending, and plan for growth.

Tax Considerations for Chiropractors

Solid bookkeeping goes hand-in-hand with fulfilling your tax obligations and optimizing deductions. Here’s what every chiropractic founder should account for:

Choosing the Right Business Structure

Whether your practice operates as a sole proprietorship, LLC, S-corp, or partnership affects your tax filings. Each has different implications for income tax, self-employment tax, and bookkeeping practices. A qualified tax advisor can help assess what works best, and resources like the SBA’s business structure guide offer helpful insights.

Ensure You Take Qualified Deductions

Chiropractors should explore these common deductible expenses:

Office lease or mortgage interest

Equipment depreciation (e.g., adjusting tables, diagnostic tools)

Health insurance premiums (if self-employed)

Continuing education and licensing costs

Professional memberships and business insurance

These deductions rely on precise, categorized financial records — underscoring why strong bookkeeping matters.

Monitor Sales Tax on Retail Products

If your practice sells supplements or health products, stay current with sales tax collection and reporting for your state. Unpaid sales tax can lead to compliance trouble and penalties.

File and Pay Taxes On Time

Set reminders or use integrated software to track all filing deadlines (quarterly estimates, payroll filings, annual returns). Staying proactive avoids last-minute stress and fines.

You can refer to detailed IRS guidance on business recordkeeping to ensure your chiropractic practice stays compliant.

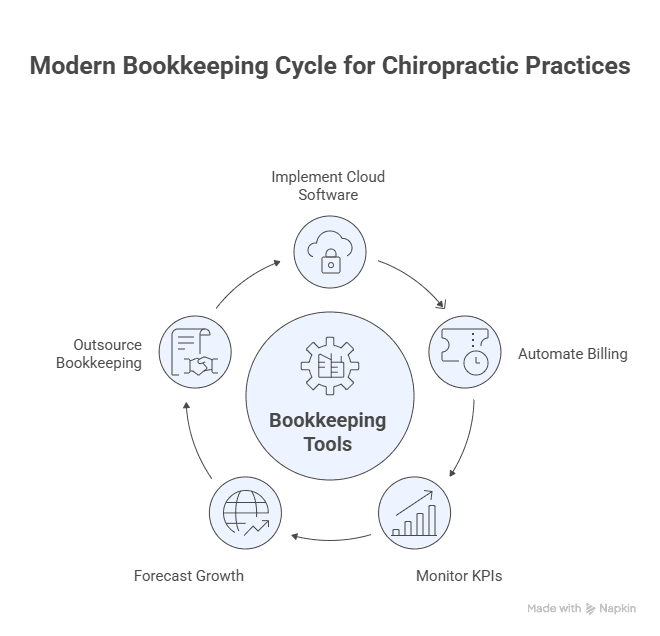

Using Modern Bookkeeping Tools to Drive Growth

Leveraging technology doesn’t just save time — it enables smarter decisions and business scale. Today’s chiropractic practices have more financial tools at their disposal than ever before:

Cloud-Based Accounting Software

Platforms like QuickBooks Online and Xero allow secure access, automated syncing with bank accounts, and real-time collaboration with your bookkeeper.

Automated Patient Billing

Use systems that integrate with your charting and EHR software to generate invoices, track receivables, and send payment reminders without manual follow-ups.

Financial KPIs and Dashboards

Gain visibility into important benchmarks:

Patient acquisition cost

Average revenue per visit

Staff costs as a percent of revenue

Customizable dashboards give founders a pulse on daily and monthly operations.

Forecasting and Scenario Planning

Model different growth paths: expanding into new locations, hiring staff, or adding services like massage therapy. Financial software can simulate outcomes based on historical data.

Outsourcing for Higher ROI

Rather than managing financials piecemeal or juggling DIY spreadsheets, chiropractors benefit from working with specialized providers. Haven’s pricing plans offer bookkeeping tailored to growing practices: accessible support, transparent pricing, and chiropractic-focused financial processes.

Confident Bookkeeping for Chiropractic Practice Success

For founders and operators of chiropractic practices, mastering bookkeeping for chiropractors is not just about compliance but about gaining clarity and control over the financial health of their business. Accurate categorization, diligent documentation, regular reconciliations, and leveraging modern bookkeeping technology transform an often-overwhelming task into a strategic asset that boosts profitability and scalability.

Haven specializes in supporting healthcare founders through comprehensive bookkeeping, tax filing, and R&D credit expertise designed for fast-growing practices. By partnering with Haven, chiropractors can enjoy peace of mind and actionable financial insights tailored to their unique business model, enabling them to focus on delivering outstanding patient care.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026