Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

R&D Tax Credit Changes 2025: A Founder’s Guide to What’s Coming (and What to Do Now)

The R&D tax credit is one of the most valuable financial incentives available to startups—but also one of the most misunderstood. With new IRS documentation rules, increased audit scrutiny, and major 2025 legislative proposals underway, founders need clarity now more than ever.

This guide breaks down exactly what’s changing, what counts as R&D, how the credit works, and how 2025 rules may impact your cash flow, runway, and tax strategy.

What the R&D Tax Credit Actually Does

The R&D tax credit rewards companies for building new technology or improving existing products. Historically, only profitable companies could use it because it offset income tax. Early-stage startups—typically unprofitable by design—were locked out.

How the PATH Act Opened Access to Startups

In 2015, the PATH Act changed everything. It allowed qualified small businesses to use the credit to offset payroll taxes, unlocking up to $500,000 per year even if the company has no profit.

To qualify, you must:

Have under $5M in gross receipts for the tax year, and

Have no more than five years of prior revenue

This shifted the R&D credit from a future benefit into immediate cash flow support, which is why it’s become a core part of tax planning for product-heavy startups.

What Counts as R&D? (More Than You Think)

No, you don’t need a PhD or a lab. Most modern engineering teams perform qualifying work daily:

Building or improving software

Developing algorithms

Designing prototypes

Testing new features

Solving technical uncertainty through experimentation

If your engineers or data scientists would describe a task as “figuring something out,” it might qualify.

The Big R&D Tax Credit Changes for 2025

The R&D landscape is shifting quickly. Here’s what’s changing—and what may change soon.

1. New IRS Reporting Requirements (Starting 2024 Returns)

Beginning with 2024 tax filings (submitted in 2025), companies claiming over $1.5M in Qualified Research Expenses must comply with stricter project-level documentation on Form 6765.

The IRS now expects:

Descriptions of each project

Business components tied to the research

Detailed R&D activities and objectives

A breakdown of expenses tied to each component

This is a major shift from prior years, where generalized descriptions were often accepted.

Bottom line: documentation is no longer optional—it’s required.

2. The IRS Is Signaling More Scrutiny

The IRS has made it clear: audits are increasing, and documentation is now the centerpiece of compliance. Startups should expect:

More detailed requests

Requests for engineering logs or commit histories

Validation of employee time spent on R&D

Good financial hygiene today prevents painful audits later.

3. Proposed 2025 Legislation: A Potential Return to Immediate Expensing

Since 2022, Section 174 has required companies to capitalize and amortize R&D expenses over:

5 years for U.S. research

15 years for foreign research

This rule dramatically reduced cash flow for startups.

The proposed American Innovation and R&D Competitiveness Act of 2025 would:

Restore immediate expensing for U.S. R&D

Apply retroactively to 2023

Keep foreign R&D amortized

If it passes, many startups may benefit from amending previously filed returns.

4. Expanded Eligibility for Payroll Tax Offsets

Proposals also include increasing the eligibility threshold from $5M to ~$15M in gross receipts and extending the qualification window.

This would allow more scaling startups—those with growing revenue but no profit—to continue using the payroll offset.

5. Modernized Definitions of R&D

Lawmakers are pushing to explicitly recognize innovation in categories like:

AI and machine learning

Cybersecurity

Clean energy and renewables

Advanced data analytics

Process automation

This removes ambiguity and better reflects how modern software companies operate.

6. Don’t Forget State-Level Credits

Many states offer their own credits, including:

California: Up to ~15% of qualifying expenses

Massachusetts: Up to ~10% and bonus benefits for smaller companies

Together with federal credits, these can unlock meaningful annual savings.

Why These Changes Matter for Startups

Immediate Expensing vs. Amortization = Real Cash Flow Impact

When expenses are amortized, you’re forced to spread deductions out over five years. That means fewer tax savings today—when you likely need cash the most.

A return to immediate expensing would:

Reduce burn

Improve runway

Unlock liquidity earlier

For fast-growing startups, that alone can be a game-changer.

Increased Reporting = More Work, But More Protection

The IRS’s shift toward documentation can feel burdensome, but it also:

Makes claims more defensible

Reduces audit exposure

Clarifies what actually qualifies

Startups that build systems early will stay ahead of compliance.

Payroll Tax Offset: Still the Fastest Cash Benefit

Even with all the changes, the payroll offset remains the most valuable part of the credit for pre-revenue or early-revenue companies.

Strategy Matters More Than Ever

Depending on what Congress passes, you may need to:

Adjust the timing of R&D spending

Amend past returns

Reassess what projects qualify under expanded definitions

Strengthen project-level documentation

Strategic planning could translate into thousands—or hundreds of thousands—in additional savings.

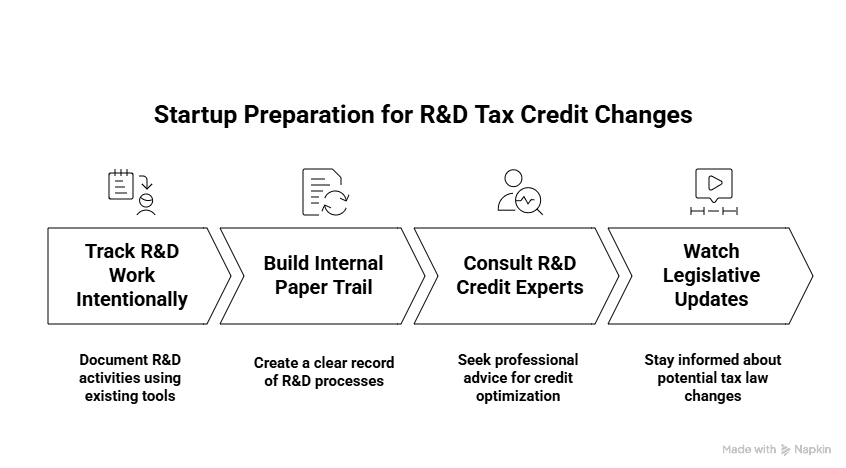

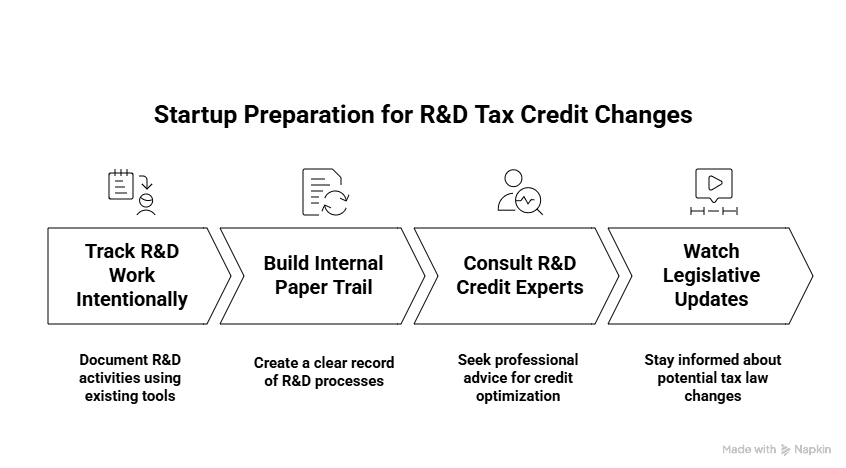

How Startups Should Prepare (Without Overhauling Everything)

1. Track R&D Work More Intentionally

Use tools your team already uses—Jira, Asana, Notion, GitHub—to document:

What was built

Why was it built

What uncertainty existed

How teams experimented or tested solutions

You don’t need new systems—just clearer habits.

2. Build a Simple Internal Paper Trail

A strong R&D claim is built from:

Time tracking (even estimates)

Engineering logs

Prototypes and iterations

Documentation of failed experiments

The IRS likes clarity. Give them clarity.

3. Consult R&D Credit Experts

The credit is too valuable—and too nuanced—to DIY. Experts can help you:

Identify qualifying projects

Navigate new Form 6765 rules

Maximize both federal and state credits

Reduce audit risk

4. Watch Legislative Updates

If immediate expensing returns, your tax strategy will change overnight. Knowing what’s coming allows you to:

Re-budget R&D spending

Accelerate projects strategically

File or amend returns for maximum benefit

Haven: R&D Tax Credits and Startup Accounting—Handled

Haven helps startups capture every eligible dollar from R&D credits while staying fully compliant with new IRS rules. We manage bookkeeping, taxes, R&D studies, and CFO support—so founders can focus on building, not deciphering tax legislation.

More than 400 startups trust Haven to stay audit-ready, maximize their R&D benefits, and keep their financial systems running smoothly.

Book a call to learn how we're helping teams navigate the 2025 R&D tax credit changes—without slowing down product velocity.

The R&D tax credit is one of the most valuable financial incentives available to startups—but also one of the most misunderstood. With new IRS documentation rules, increased audit scrutiny, and major 2025 legislative proposals underway, founders need clarity now more than ever.

This guide breaks down exactly what’s changing, what counts as R&D, how the credit works, and how 2025 rules may impact your cash flow, runway, and tax strategy.

What the R&D Tax Credit Actually Does

The R&D tax credit rewards companies for building new technology or improving existing products. Historically, only profitable companies could use it because it offset income tax. Early-stage startups—typically unprofitable by design—were locked out.

How the PATH Act Opened Access to Startups

In 2015, the PATH Act changed everything. It allowed qualified small businesses to use the credit to offset payroll taxes, unlocking up to $500,000 per year even if the company has no profit.

To qualify, you must:

Have under $5M in gross receipts for the tax year, and

Have no more than five years of prior revenue

This shifted the R&D credit from a future benefit into immediate cash flow support, which is why it’s become a core part of tax planning for product-heavy startups.

What Counts as R&D? (More Than You Think)

No, you don’t need a PhD or a lab. Most modern engineering teams perform qualifying work daily:

Building or improving software

Developing algorithms

Designing prototypes

Testing new features

Solving technical uncertainty through experimentation

If your engineers or data scientists would describe a task as “figuring something out,” it might qualify.

The Big R&D Tax Credit Changes for 2025

The R&D landscape is shifting quickly. Here’s what’s changing—and what may change soon.

1. New IRS Reporting Requirements (Starting 2024 Returns)

Beginning with 2024 tax filings (submitted in 2025), companies claiming over $1.5M in Qualified Research Expenses must comply with stricter project-level documentation on Form 6765.

The IRS now expects:

Descriptions of each project

Business components tied to the research

Detailed R&D activities and objectives

A breakdown of expenses tied to each component

This is a major shift from prior years, where generalized descriptions were often accepted.

Bottom line: documentation is no longer optional—it’s required.

2. The IRS Is Signaling More Scrutiny

The IRS has made it clear: audits are increasing, and documentation is now the centerpiece of compliance. Startups should expect:

More detailed requests

Requests for engineering logs or commit histories

Validation of employee time spent on R&D

Good financial hygiene today prevents painful audits later.

3. Proposed 2025 Legislation: A Potential Return to Immediate Expensing

Since 2022, Section 174 has required companies to capitalize and amortize R&D expenses over:

5 years for U.S. research

15 years for foreign research

This rule dramatically reduced cash flow for startups.

The proposed American Innovation and R&D Competitiveness Act of 2025 would:

Restore immediate expensing for U.S. R&D

Apply retroactively to 2023

Keep foreign R&D amortized

If it passes, many startups may benefit from amending previously filed returns.

4. Expanded Eligibility for Payroll Tax Offsets

Proposals also include increasing the eligibility threshold from $5M to ~$15M in gross receipts and extending the qualification window.

This would allow more scaling startups—those with growing revenue but no profit—to continue using the payroll offset.

5. Modernized Definitions of R&D

Lawmakers are pushing to explicitly recognize innovation in categories like:

AI and machine learning

Cybersecurity

Clean energy and renewables

Advanced data analytics

Process automation

This removes ambiguity and better reflects how modern software companies operate.

6. Don’t Forget State-Level Credits

Many states offer their own credits, including:

California: Up to ~15% of qualifying expenses

Massachusetts: Up to ~10% and bonus benefits for smaller companies

Together with federal credits, these can unlock meaningful annual savings.

Why These Changes Matter for Startups

Immediate Expensing vs. Amortization = Real Cash Flow Impact

When expenses are amortized, you’re forced to spread deductions out over five years. That means fewer tax savings today—when you likely need cash the most.

A return to immediate expensing would:

Reduce burn

Improve runway

Unlock liquidity earlier

For fast-growing startups, that alone can be a game-changer.

Increased Reporting = More Work, But More Protection

The IRS’s shift toward documentation can feel burdensome, but it also:

Makes claims more defensible

Reduces audit exposure

Clarifies what actually qualifies

Startups that build systems early will stay ahead of compliance.

Payroll Tax Offset: Still the Fastest Cash Benefit

Even with all the changes, the payroll offset remains the most valuable part of the credit for pre-revenue or early-revenue companies.

Strategy Matters More Than Ever

Depending on what Congress passes, you may need to:

Adjust the timing of R&D spending

Amend past returns

Reassess what projects qualify under expanded definitions

Strengthen project-level documentation

Strategic planning could translate into thousands—or hundreds of thousands—in additional savings.

How Startups Should Prepare (Without Overhauling Everything)

1. Track R&D Work More Intentionally

Use tools your team already uses—Jira, Asana, Notion, GitHub—to document:

What was built

Why was it built

What uncertainty existed

How teams experimented or tested solutions

You don’t need new systems—just clearer habits.

2. Build a Simple Internal Paper Trail

A strong R&D claim is built from:

Time tracking (even estimates)

Engineering logs

Prototypes and iterations

Documentation of failed experiments

The IRS likes clarity. Give them clarity.

3. Consult R&D Credit Experts

The credit is too valuable—and too nuanced—to DIY. Experts can help you:

Identify qualifying projects

Navigate new Form 6765 rules

Maximize both federal and state credits

Reduce audit risk

4. Watch Legislative Updates

If immediate expensing returns, your tax strategy will change overnight. Knowing what’s coming allows you to:

Re-budget R&D spending

Accelerate projects strategically

File or amend returns for maximum benefit

Haven: R&D Tax Credits and Startup Accounting—Handled

Haven helps startups capture every eligible dollar from R&D credits while staying fully compliant with new IRS rules. We manage bookkeeping, taxes, R&D studies, and CFO support—so founders can focus on building, not deciphering tax legislation.

More than 400 startups trust Haven to stay audit-ready, maximize their R&D benefits, and keep their financial systems running smoothly.

Book a call to learn how we're helping teams navigate the 2025 R&D tax credit changes—without slowing down product velocity.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026