Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

Understanding R&D Capitalization for Tech and Startup Founders

R&D capitalization is the process of recording research and development costs as a long-term asset instead of expensing them immediately. Under post-2022 IRS rules, all R&D costs must be capitalized and amortized over five years for U.S. development and fifteen years for foreign development.

R&D accounting rules changed in 2022, and they now affect your runway, burn rate, and tax bill in ways most founders don’t expect. If you build software, ship fast, or run a product‑heavy roadmap, you need to understand how R&D capitalization works and when it makes sense to use it.

This guide breaks down the rules without jargon. You’ll see how capitalization affects your financials, how amortization works, and when founders should (and shouldn’t) capitalize costs.

What Is R&D Capitalization?

R&D capitalization means recording research and development expenses as an asset instead of taking a full expense on your P&L today. For startups investing heavily in product, this changes how profit, EBITDA, and investor-facing metrics appear.

When you capitalize R&D:

The cost goes on your balance sheet.

You amortize it over several years.

Your P&L shows higher near-term profitability.

Investor metrics become smoother and more comparable over time.

When you expense R&D:

You deduct everything immediately.

Profit drops in the current year.

Metrics look more volatile.

For software companies, this choice affects everything from burn-rate reporting to fundraising decks.

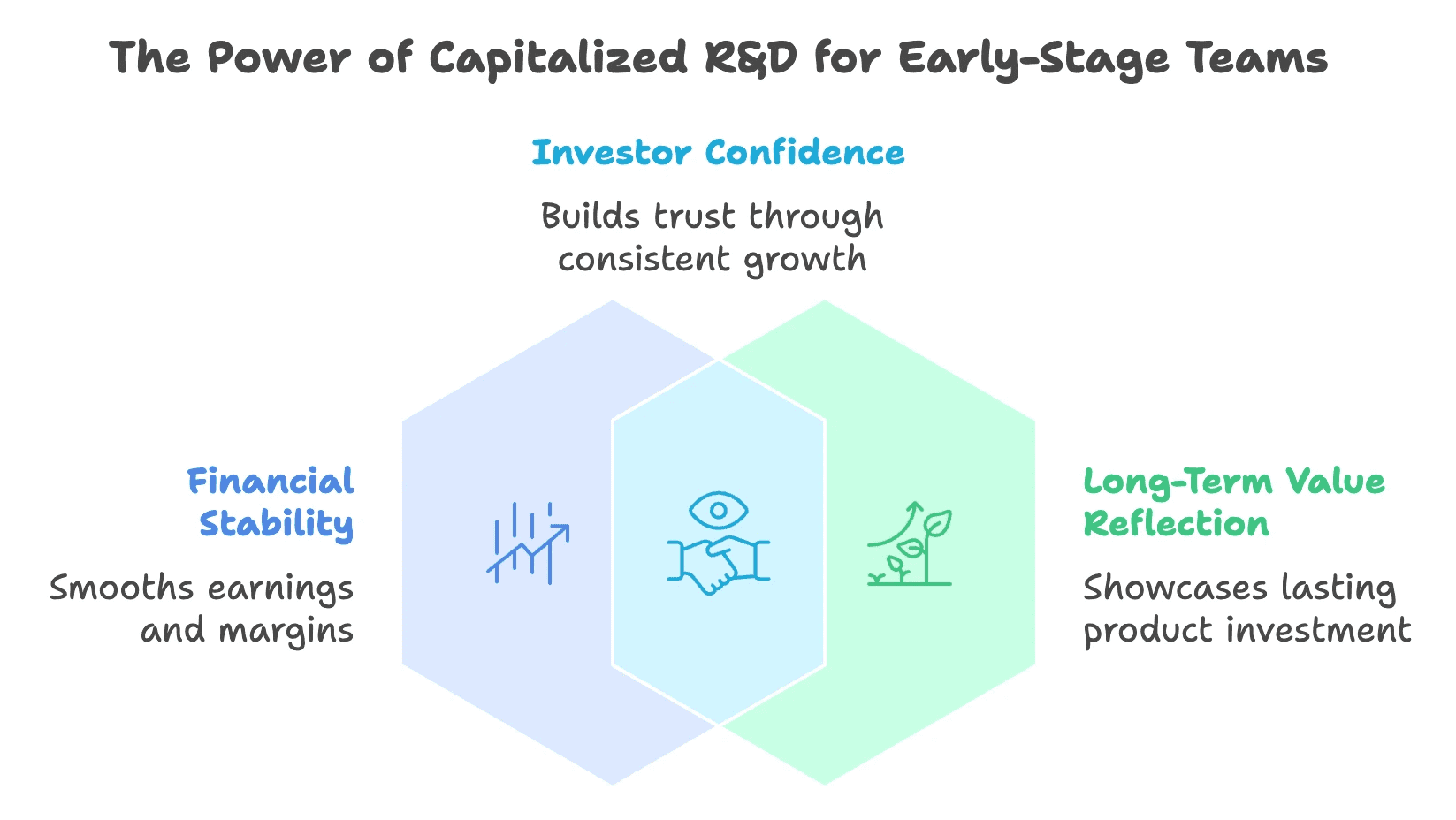

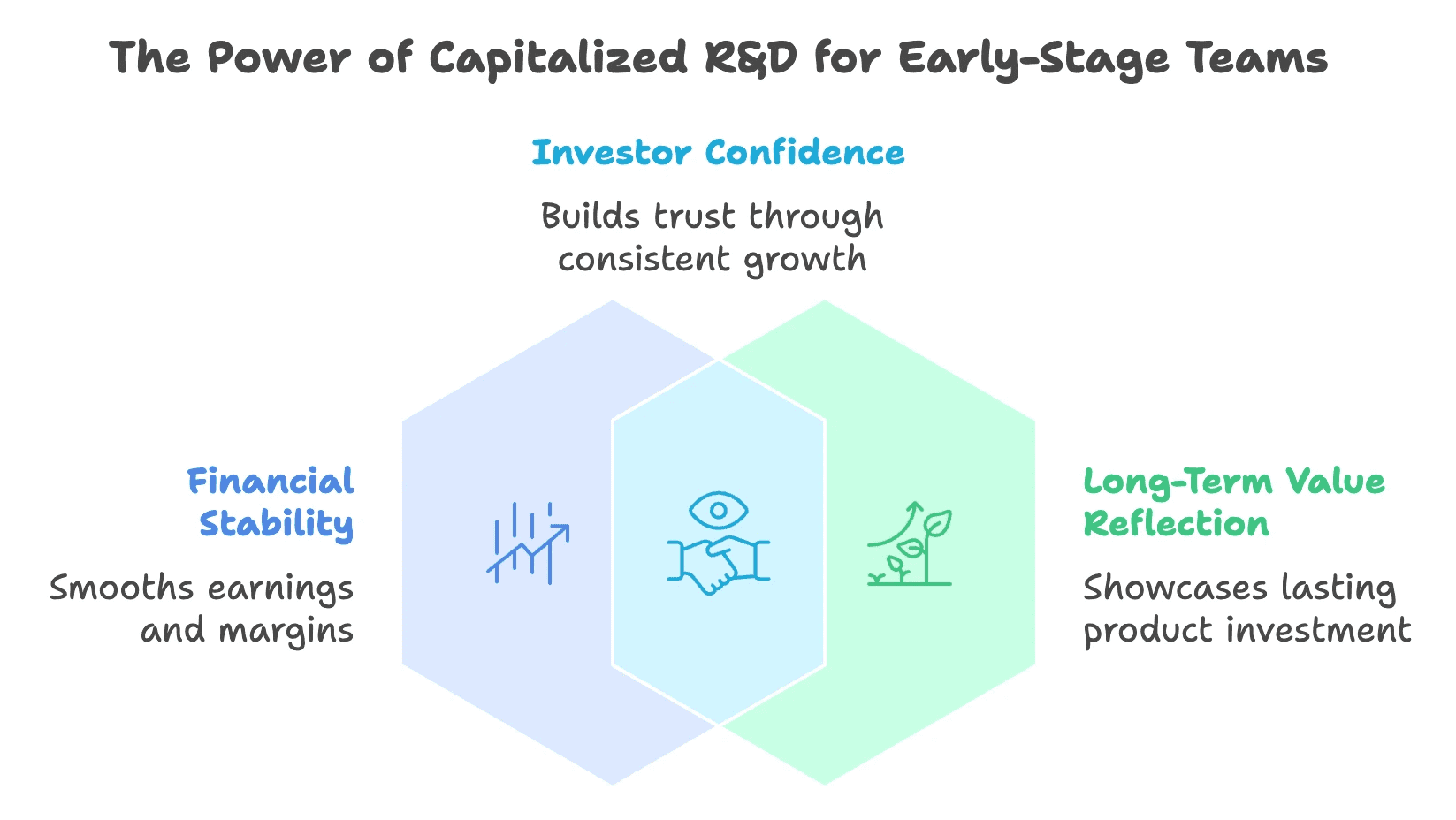

Why Capitalize R&D?

Capitalizing development costs spreads the expense over time. Instead of taking the full hit today, you amortize the cost across future years—the same years the product generates revenue.

For early-stage teams, capitalized R&D can:

Reduce volatility in EBITDA

Present cleaner, more consistent margins

Reflect the long-term value of product investment

Improve comparability across reporting periods

This is why many tech companies adopt a capitalization strategy once engineering spend grows.

How R&D Capitalization Works for U.S. Tax Purposes (Post-2021 Rules)

In 2022, tax treatment changed across the board. Regardless of GAAP or IFRS, the IRS now requires all R&D costs—U.S. and foreign—to be capitalized for tax purposes.

This applies to:

Software development

Engineering work

Product iteration

Testing and QA

Domestic and international R&D efforts

Even if you want to expense the work for bookkeeping, tax rules force capitalization.

Five-Year vs. Fifteen-Year Amortization

The IRS requires different amortization schedules depending on where the work is done:

U.S.-based R&D: amortized over five years

Foreign R&D: amortized over 15 years

This creates a major cash-flow impact. Instead of deducting 100% in year one, you deduct only a fraction.

The result: phantom income

You can owe taxes even while operating at a loss because the deduction is spread over future years. This surprises many founders during their first post-2022 tax season.

Capitalized vs. Non‑Capitalized Costs

Capitalizable:

Software development after feasibility

Engineering work tied to a specific product build

Patent application costs

Expensed:

Early research

Market testing

Surveys

General admin or overhead

What Might Change in 2025?

Legislators have proposed restoring full expensing for U.S.-based R&D through 2025.

Nothing is final yet, so model both outcomes until guidance is official.

GAAP vs. IFRS Treatment of R&D (Side-by-Side Comparison)

Founders often assume all accounting frameworks treat R&D the same way. They don’t. GAAP is strict. IFRS is flexible. Startups with global operations or international subsidiaries may report very different metrics depending on the framework.

R&D Accounting: GAAP vs. IFRS

Category | GAAP (U.S.) | IFRS (International) |

Overall Approach | Expense most R&D immediately. Capitalization allowed only in narrow software-development phases. | Allows capitalization of development costs once feasibility and economic benefit are demonstrated. |

Research Phase | Always expensed. | Always expensed. |

Development Phase | Generally expensed unless software hits technological feasibility (ASC 985 for marketed software / ASC 350 for internal-use). | Capitalized if the project meets all 6 IFRS criteria: feasibility, intent, ability to use/sell, economic benefit, resources, and reliable measurement. |

Software Development – Internal Use (ASC 350) | Capitalize certain coding, configuration, and testing costs after planning stage. | Treated as development; can be capitalized if feasibility and benefit are established. |

Software Development – Marketed Software (ASC 985) | Capitalize only after technological feasibility and before commercial release. | No “technological feasibility” threshold; broader capitalization allowed. |

Post-Implementation / Maintenance | Expensed. | Expensed. |

Intangible Asset Recognition | Rare for startups due to strict feasibility rules. | Common for startups; development assets appear on the balance sheet. |

Impact on Profitability Metrics | Lower near-term profitability because most costs hit the P&L immediately. | Higher near-term profitability because more development costs are capitalized. |

Impact on Investors | Metrics are conservative and volatile. | Metrics appear smoother and more “enterprise-like.” |

Common Startup Outcome | Expense nearly everything unless you’re in a late-stage software cycle. | Capitalize development spend earlier in the product lifecycle. |

Why GAAP Is Stricter

GAAP wants to avoid overstating a startup’s assets. Under U.S. rules, you must prove software is “technologically feasible” before capitalizing development costs — and in fast-moving environments, feasibility can last only a few days or weeks.

That’s why most U.S. startups default to expensing nearly everything.

Why IFRS Is More Flexible

IFRS focuses on whether:

the product will generate future economic benefits

the team can reliably measure development spend

the technology is feasible

If those conditions are met, IFRS allows capitalization far earlier than GAAP. This can materially change profitability, EBITDA, and valuation optics.

How R&D Capitalization Works

Capitalization affects both tax strategy and budgeting. You spend the same cash, but the tax deduction spreads out.

Real‑World Example

A startup with $1M revenue and $1.5M R&D spend:

Old rules: full $1.5M deduction → no tax owed

New rules: only $300K deduction (one‑fifth) → $147K tax bill despite a $500K economic loss

Budget and Runway Impact

Capitalization changes how your burn rate appears on paper and can shorten runway if you’re not modeling amortization correctly.

Benefits for Startups & Tech Companies

More Accurate Profitability

Capitalizing R&D aligns spend with future revenue, reducing noise in investor‑facing metrics.

Higher EBITDA and Cleaner Ratios

Shifting early R&D off the income statement boosts:

Net income

EBITDA

ROA and ROE

Smoother Cash Flow Planning

Amortization helps founders forecast margins and model long‑term ROI more accurately.

GAAP Requirements for Software R&D

Internal‑Use Software (ASC 350)

Planning stage: Expense

Development stage: Capitalize qualifying costs

Post‑implementation: Expense again

External (Marketed) Software (ASC 985)

Planning: Expense

After technological feasibility: Capitalize

Post‑release: Expense

Capitalization windows for startups are short. If you ship fast, feasibility‑to‑release may be only a few weeks.

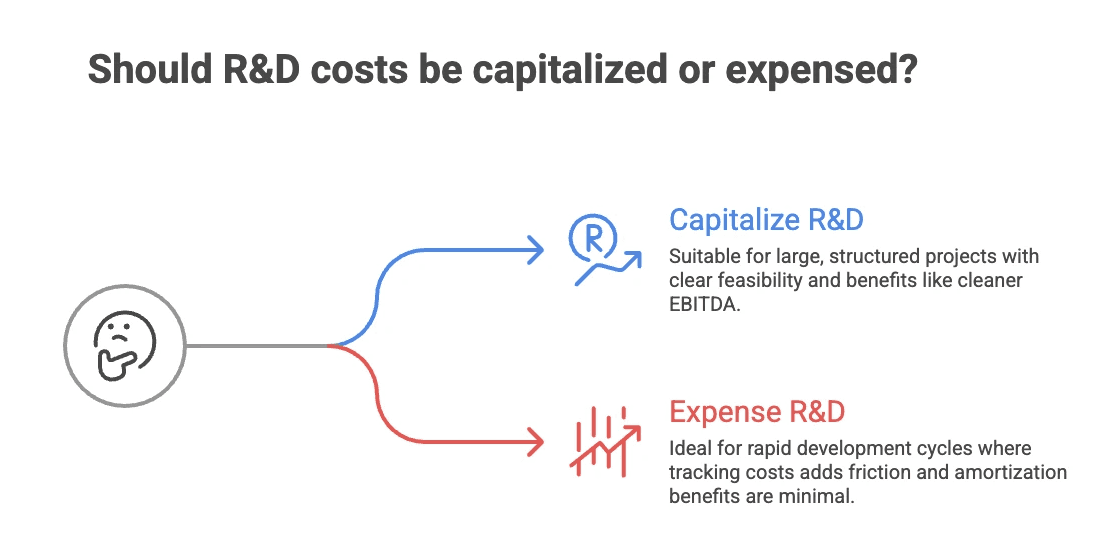

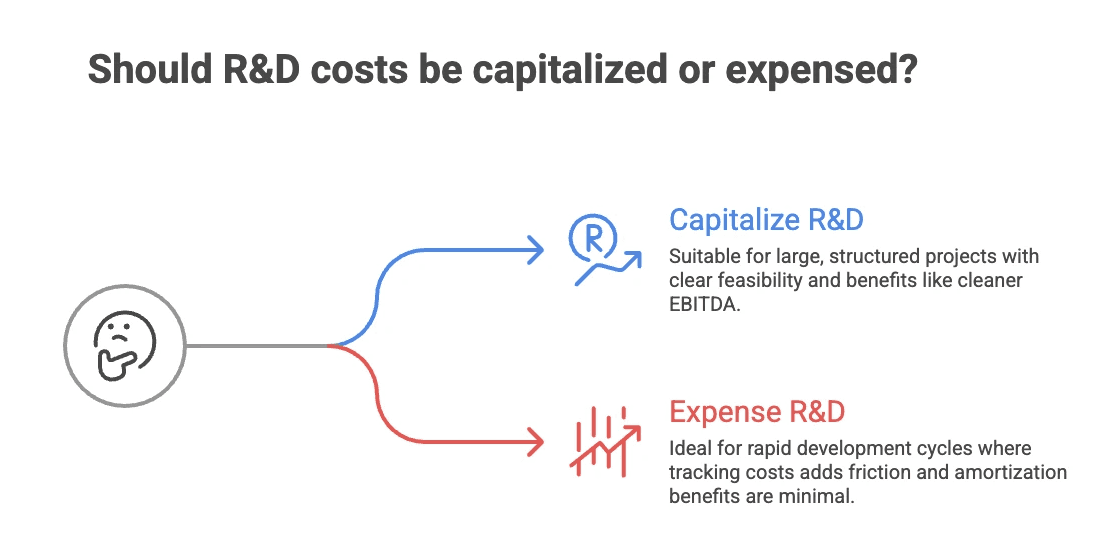

Should You Capitalize R&D Costs?

Capitalize when:

The project is large, structured, and easy to track

You want cleaner EBITDA or investor optics

You have a clear feasibility window

Expense everything when:

Tracking costs adds operational friction

The development cycle is rapid

The amortization benefit isn’t worth the bookkeeping overhead

Haven: Financial Ops for Startups, Handled

We manage your bookkeeping, taxes, R&D credit workflow, and CFO reporting—all with sub‑5‑minute response times and startup‑ready accounting. More than 400 startups rely on Haven to stay compliant, capture tax credits, and free up hours every month.

Book a call and get financial ops that move as fast as you do.than bookkeeping.

R&D capitalization is the process of recording research and development costs as a long-term asset instead of expensing them immediately. Under post-2022 IRS rules, all R&D costs must be capitalized and amortized over five years for U.S. development and fifteen years for foreign development.

R&D accounting rules changed in 2022, and they now affect your runway, burn rate, and tax bill in ways most founders don’t expect. If you build software, ship fast, or run a product‑heavy roadmap, you need to understand how R&D capitalization works and when it makes sense to use it.

This guide breaks down the rules without jargon. You’ll see how capitalization affects your financials, how amortization works, and when founders should (and shouldn’t) capitalize costs.

What Is R&D Capitalization?

R&D capitalization means recording research and development expenses as an asset instead of taking a full expense on your P&L today. For startups investing heavily in product, this changes how profit, EBITDA, and investor-facing metrics appear.

When you capitalize R&D:

The cost goes on your balance sheet.

You amortize it over several years.

Your P&L shows higher near-term profitability.

Investor metrics become smoother and more comparable over time.

When you expense R&D:

You deduct everything immediately.

Profit drops in the current year.

Metrics look more volatile.

For software companies, this choice affects everything from burn-rate reporting to fundraising decks.

Why Capitalize R&D?

Capitalizing development costs spreads the expense over time. Instead of taking the full hit today, you amortize the cost across future years—the same years the product generates revenue.

For early-stage teams, capitalized R&D can:

Reduce volatility in EBITDA

Present cleaner, more consistent margins

Reflect the long-term value of product investment

Improve comparability across reporting periods

This is why many tech companies adopt a capitalization strategy once engineering spend grows.

How R&D Capitalization Works for U.S. Tax Purposes (Post-2021 Rules)

In 2022, tax treatment changed across the board. Regardless of GAAP or IFRS, the IRS now requires all R&D costs—U.S. and foreign—to be capitalized for tax purposes.

This applies to:

Software development

Engineering work

Product iteration

Testing and QA

Domestic and international R&D efforts

Even if you want to expense the work for bookkeeping, tax rules force capitalization.

Five-Year vs. Fifteen-Year Amortization

The IRS requires different amortization schedules depending on where the work is done:

U.S.-based R&D: amortized over five years

Foreign R&D: amortized over 15 years

This creates a major cash-flow impact. Instead of deducting 100% in year one, you deduct only a fraction.

The result: phantom income

You can owe taxes even while operating at a loss because the deduction is spread over future years. This surprises many founders during their first post-2022 tax season.

Capitalized vs. Non‑Capitalized Costs

Capitalizable:

Software development after feasibility

Engineering work tied to a specific product build

Patent application costs

Expensed:

Early research

Market testing

Surveys

General admin or overhead

What Might Change in 2025?

Legislators have proposed restoring full expensing for U.S.-based R&D through 2025.

Nothing is final yet, so model both outcomes until guidance is official.

GAAP vs. IFRS Treatment of R&D (Side-by-Side Comparison)

Founders often assume all accounting frameworks treat R&D the same way. They don’t. GAAP is strict. IFRS is flexible. Startups with global operations or international subsidiaries may report very different metrics depending on the framework.

R&D Accounting: GAAP vs. IFRS

Category | GAAP (U.S.) | IFRS (International) |

Overall Approach | Expense most R&D immediately. Capitalization allowed only in narrow software-development phases. | Allows capitalization of development costs once feasibility and economic benefit are demonstrated. |

Research Phase | Always expensed. | Always expensed. |

Development Phase | Generally expensed unless software hits technological feasibility (ASC 985 for marketed software / ASC 350 for internal-use). | Capitalized if the project meets all 6 IFRS criteria: feasibility, intent, ability to use/sell, economic benefit, resources, and reliable measurement. |

Software Development – Internal Use (ASC 350) | Capitalize certain coding, configuration, and testing costs after planning stage. | Treated as development; can be capitalized if feasibility and benefit are established. |

Software Development – Marketed Software (ASC 985) | Capitalize only after technological feasibility and before commercial release. | No “technological feasibility” threshold; broader capitalization allowed. |

Post-Implementation / Maintenance | Expensed. | Expensed. |

Intangible Asset Recognition | Rare for startups due to strict feasibility rules. | Common for startups; development assets appear on the balance sheet. |

Impact on Profitability Metrics | Lower near-term profitability because most costs hit the P&L immediately. | Higher near-term profitability because more development costs are capitalized. |

Impact on Investors | Metrics are conservative and volatile. | Metrics appear smoother and more “enterprise-like.” |

Common Startup Outcome | Expense nearly everything unless you’re in a late-stage software cycle. | Capitalize development spend earlier in the product lifecycle. |

Why GAAP Is Stricter

GAAP wants to avoid overstating a startup’s assets. Under U.S. rules, you must prove software is “technologically feasible” before capitalizing development costs — and in fast-moving environments, feasibility can last only a few days or weeks.

That’s why most U.S. startups default to expensing nearly everything.

Why IFRS Is More Flexible

IFRS focuses on whether:

the product will generate future economic benefits

the team can reliably measure development spend

the technology is feasible

If those conditions are met, IFRS allows capitalization far earlier than GAAP. This can materially change profitability, EBITDA, and valuation optics.

How R&D Capitalization Works

Capitalization affects both tax strategy and budgeting. You spend the same cash, but the tax deduction spreads out.

Real‑World Example

A startup with $1M revenue and $1.5M R&D spend:

Old rules: full $1.5M deduction → no tax owed

New rules: only $300K deduction (one‑fifth) → $147K tax bill despite a $500K economic loss

Budget and Runway Impact

Capitalization changes how your burn rate appears on paper and can shorten runway if you’re not modeling amortization correctly.

Benefits for Startups & Tech Companies

More Accurate Profitability

Capitalizing R&D aligns spend with future revenue, reducing noise in investor‑facing metrics.

Higher EBITDA and Cleaner Ratios

Shifting early R&D off the income statement boosts:

Net income

EBITDA

ROA and ROE

Smoother Cash Flow Planning

Amortization helps founders forecast margins and model long‑term ROI more accurately.

GAAP Requirements for Software R&D

Internal‑Use Software (ASC 350)

Planning stage: Expense

Development stage: Capitalize qualifying costs

Post‑implementation: Expense again

External (Marketed) Software (ASC 985)

Planning: Expense

After technological feasibility: Capitalize

Post‑release: Expense

Capitalization windows for startups are short. If you ship fast, feasibility‑to‑release may be only a few weeks.

Should You Capitalize R&D Costs?

Capitalize when:

The project is large, structured, and easy to track

You want cleaner EBITDA or investor optics

You have a clear feasibility window

Expense everything when:

Tracking costs adds operational friction

The development cycle is rapid

The amortization benefit isn’t worth the bookkeeping overhead

Haven: Financial Ops for Startups, Handled

We manage your bookkeeping, taxes, R&D credit workflow, and CFO reporting—all with sub‑5‑minute response times and startup‑ready accounting. More than 400 startups rely on Haven to stay compliant, capture tax credits, and free up hours every month.

Book a call and get financial ops that move as fast as you do.than bookkeeping.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026