Go Back

Last Updated :

Last Updated :

Nov 17, 2025

Nov 17, 2025

Bookkeeper vs Controller: Which Role Do You Really Need?

Every business—no matter its size—has to manage money flowing in and out. At first, it feels simple: send invoices, pay bills, check the bank balance. But as your business grows, you start asking bigger questions.

Do you just need someone to keep the numbers accurate? Or do you need deeper insight into what those numbers actually mean? That’s where the difference between a bookkeeper and a controller becomes essential. This guide breaks down what each role does, how they support your business, and how to decide which one fits your stage of growth.

And if you’d rather skip the cost and complexity of hiring full-time finance staff, Haven gives you the best of both — the accuracy of bookkeeping with the strategic insight of a controller.

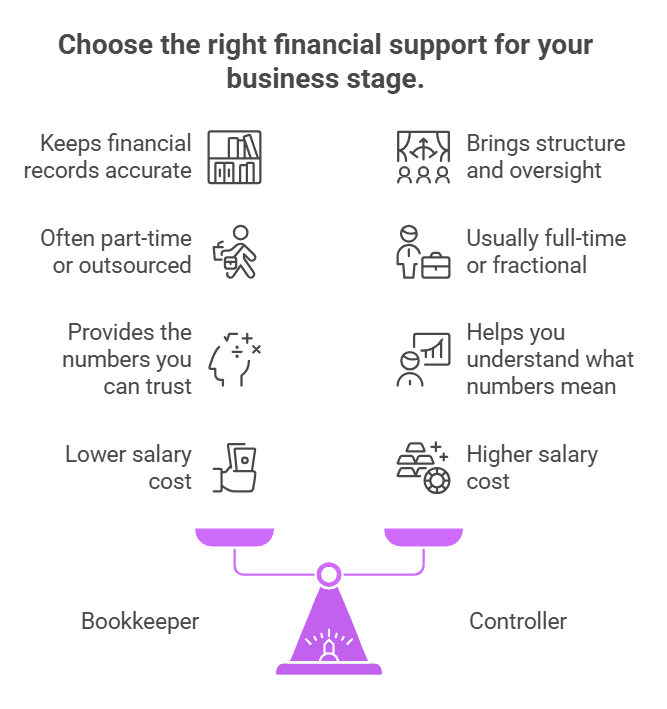

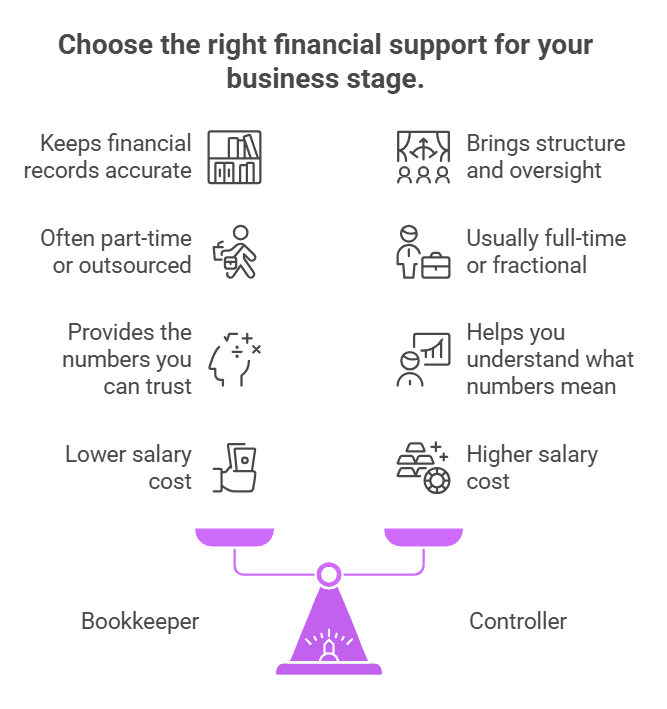

Quick Comparison: Bookkeeper vs Controller

Aspect | Bookkeeper | Controller |

Role in the Business | Keeps financial records accurate and up to date | Brings structure, oversight, and deeper insight |

Level of Involvement | Often part-time or outsourced | Usually full-time or fractional once scaling |

When You Need One | From day one, as soon as money starts moving | After steady revenue, team growth, or investor reporting |

Impact on Decisions | Provides the numbers you can trust | Helps you understand what those numbers mean |

Typical Salary (U.S.) | ~$700–$2,000/month (outsourced) | ~$120,000/year (full-time) |

Common Setup | Freelancers or accounting firms | First internal finance hire before a CFO |

What Does a Bookkeeper Do?

A bookkeeper handles your daily financial operations — tracking income, expenses, and transactions so everything stays accurate and organized.

Their role isn’t about strategy or forecasting; it’s about building a clean financial foundation your business can rely on. When transactions are recorded and reconciled in real time, you get a live picture of your financial health — not a retroactive snapshot.

Key responsibilities of a bookkeeper

Recording income and expenses accurately

Reconciling bank and credit accounts

Managing accounts payable and receivable

Categorizing transactions for tax readiness

Maintaining organized financial records

A good bookkeeper does more than data entry. They’re often the first to spot small issues — like duplicate charges or unexpected fees — before they become costly mistakes.

Clean, consistent books help you see how cash moves through your business: which clients pay on time, where costs are rising, and how much runway you actually have.

Bookkeepers don’t interpret the numbers — that’s where a controller or CFO steps in — but they ensure those numbers are correct and decision-ready.

Note: Bookkeepers and accountants are not the same. Bookkeepers manage the daily records, while accountants typically handle tax filings and high-level financial planning.

What Does a Controller Do?

If bookkeepers manage the details, controllers manage the big picture.

A controller is the bridge between day-to-day bookkeeping and higher-level financial strategy. Their goal is to ensure your financial data is not only accurate but also meaningful.

Controllers oversee bookkeepers’ work, establish financial systems, and deliver insight that supports smarter business decisions.

Key responsibilities of a controller

Reviewing and closing monthly financials

Implementing accounting processes and controls

Preparing management reports and forecasts

Supporting compliance and audit readiness

Analyzing profitability, budgets, and variance trends

For founders, the value of a controller lies in visibility and context. Instead of asking “what happened?” you start asking “why did it happen — and what should we do next?”

A great controller connects raw numbers to business outcomes. They help you spot risks, forecast cash flow, and decide when it’s time to scale, hire, or reinvest.

How to Choose the Right Financial Support for Your Business

So, do you need a bookkeeper or a controller? The answer depends on your stage, goals, and financial complexity. Here’s how to think through the decision.

1. Consider the Stage of Your Business

In early stages, accuracy is the priority.If you’re processing a few invoices a month, a bookkeeper is enough to keep things organized for tax time.

But as you scale — adding payroll, vendors, or investors — a controller becomes essential. They bring process, structure, and accountability so your reporting can keep up with growth.

2. Evaluate Your Transaction Volume and Complexity

It’s not just about how much revenue you earn — it’s about how much money moves through your systems.

Few clients and simple expenses? You need bookkeeping.

Multiple revenue streams, recurring payments, or international accounts? You need controller-level oversight.

Controllers ensure reporting stays accurate as the business grows in complexity.

3. Match Financial Support to Decision-Making Needs

Ask yourself:

If you’re asking, “How much did we spend last month?” → you need a bookkeeper.

If you’re asking, “Why are our costs rising?” or “Can we afford another hire next quarter?” → that’s a controller’s job.

Bookkeepers give you reliable data. Controllers turn that data into strategic insight.

4. Weigh the Cost and Commitment

Bookkeepers are typically more affordable and available part-time or through outsourcing. Controllers, on the other hand, are higher-level hires — often full-time and commanding higher salaries.

A small design studio might need only a bookkeeper to stay compliant and tax-ready.

But a growing agency with payroll, investors, and expanding operations likely needs a controller to guide financial decisions.

Not Sure Which Role to Hire? Here’s How Haven Helps

Choosing between a bookkeeper and a controller isn’t really about titles — it’s about what level of financial visibility your business needs right now.

Here’s a simple framework to help you decide:

Question | Bookkeeper | Controller |

How complex are your finances? | Simple cash flow, few vendors | Multiple accounts, complex operations |

Are your reports accurate? | Keeps data clean and up to date | Adds interpretation and strategy |

What decisions are you making? | Short-term, reactive | Long-term, data-informed |

Do you need speed or structure? | Accuracy and timeliness | Systems and insights |

If managing this balance feels overwhelming, Haven can help.

Haven gives you the full financial support of both a bookkeeper and a controller, without the overhead of hiring in-house.

With Haven, you’ll:

Get accurate, stress-free bookkeeping every month — no late reconciliations or missing data

Receive clean, real-time financial reports that show how your business is performing

Stay ahead on tax strategy and compliance with proactive support

Reach your finance team instantly in Slack and get answers in minutes — not weeks

Book your free strategy call and see how Haven can handle your books, reporting, and taxes — so you can stay focused on building your business.

Every business—no matter its size—has to manage money flowing in and out. At first, it feels simple: send invoices, pay bills, check the bank balance. But as your business grows, you start asking bigger questions.

Do you just need someone to keep the numbers accurate? Or do you need deeper insight into what those numbers actually mean? That’s where the difference between a bookkeeper and a controller becomes essential. This guide breaks down what each role does, how they support your business, and how to decide which one fits your stage of growth.

And if you’d rather skip the cost and complexity of hiring full-time finance staff, Haven gives you the best of both — the accuracy of bookkeeping with the strategic insight of a controller.

Quick Comparison: Bookkeeper vs Controller

Aspect | Bookkeeper | Controller |

Role in the Business | Keeps financial records accurate and up to date | Brings structure, oversight, and deeper insight |

Level of Involvement | Often part-time or outsourced | Usually full-time or fractional once scaling |

When You Need One | From day one, as soon as money starts moving | After steady revenue, team growth, or investor reporting |

Impact on Decisions | Provides the numbers you can trust | Helps you understand what those numbers mean |

Typical Salary (U.S.) | ~$700–$2,000/month (outsourced) | ~$120,000/year (full-time) |

Common Setup | Freelancers or accounting firms | First internal finance hire before a CFO |

What Does a Bookkeeper Do?

A bookkeeper handles your daily financial operations — tracking income, expenses, and transactions so everything stays accurate and organized.

Their role isn’t about strategy or forecasting; it’s about building a clean financial foundation your business can rely on. When transactions are recorded and reconciled in real time, you get a live picture of your financial health — not a retroactive snapshot.

Key responsibilities of a bookkeeper

Recording income and expenses accurately

Reconciling bank and credit accounts

Managing accounts payable and receivable

Categorizing transactions for tax readiness

Maintaining organized financial records

A good bookkeeper does more than data entry. They’re often the first to spot small issues — like duplicate charges or unexpected fees — before they become costly mistakes.

Clean, consistent books help you see how cash moves through your business: which clients pay on time, where costs are rising, and how much runway you actually have.

Bookkeepers don’t interpret the numbers — that’s where a controller or CFO steps in — but they ensure those numbers are correct and decision-ready.

Note: Bookkeepers and accountants are not the same. Bookkeepers manage the daily records, while accountants typically handle tax filings and high-level financial planning.

What Does a Controller Do?

If bookkeepers manage the details, controllers manage the big picture.

A controller is the bridge between day-to-day bookkeeping and higher-level financial strategy. Their goal is to ensure your financial data is not only accurate but also meaningful.

Controllers oversee bookkeepers’ work, establish financial systems, and deliver insight that supports smarter business decisions.

Key responsibilities of a controller

Reviewing and closing monthly financials

Implementing accounting processes and controls

Preparing management reports and forecasts

Supporting compliance and audit readiness

Analyzing profitability, budgets, and variance trends

For founders, the value of a controller lies in visibility and context. Instead of asking “what happened?” you start asking “why did it happen — and what should we do next?”

A great controller connects raw numbers to business outcomes. They help you spot risks, forecast cash flow, and decide when it’s time to scale, hire, or reinvest.

How to Choose the Right Financial Support for Your Business

So, do you need a bookkeeper or a controller? The answer depends on your stage, goals, and financial complexity. Here’s how to think through the decision.

1. Consider the Stage of Your Business

In early stages, accuracy is the priority.If you’re processing a few invoices a month, a bookkeeper is enough to keep things organized for tax time.

But as you scale — adding payroll, vendors, or investors — a controller becomes essential. They bring process, structure, and accountability so your reporting can keep up with growth.

2. Evaluate Your Transaction Volume and Complexity

It’s not just about how much revenue you earn — it’s about how much money moves through your systems.

Few clients and simple expenses? You need bookkeeping.

Multiple revenue streams, recurring payments, or international accounts? You need controller-level oversight.

Controllers ensure reporting stays accurate as the business grows in complexity.

3. Match Financial Support to Decision-Making Needs

Ask yourself:

If you’re asking, “How much did we spend last month?” → you need a bookkeeper.

If you’re asking, “Why are our costs rising?” or “Can we afford another hire next quarter?” → that’s a controller’s job.

Bookkeepers give you reliable data. Controllers turn that data into strategic insight.

4. Weigh the Cost and Commitment

Bookkeepers are typically more affordable and available part-time or through outsourcing. Controllers, on the other hand, are higher-level hires — often full-time and commanding higher salaries.

A small design studio might need only a bookkeeper to stay compliant and tax-ready.

But a growing agency with payroll, investors, and expanding operations likely needs a controller to guide financial decisions.

Not Sure Which Role to Hire? Here’s How Haven Helps

Choosing between a bookkeeper and a controller isn’t really about titles — it’s about what level of financial visibility your business needs right now.

Here’s a simple framework to help you decide:

Question | Bookkeeper | Controller |

How complex are your finances? | Simple cash flow, few vendors | Multiple accounts, complex operations |

Are your reports accurate? | Keeps data clean and up to date | Adds interpretation and strategy |

What decisions are you making? | Short-term, reactive | Long-term, data-informed |

Do you need speed or structure? | Accuracy and timeliness | Systems and insights |

If managing this balance feels overwhelming, Haven can help.

Haven gives you the full financial support of both a bookkeeper and a controller, without the overhead of hiring in-house.

With Haven, you’ll:

Get accurate, stress-free bookkeeping every month — no late reconciliations or missing data

Receive clean, real-time financial reports that show how your business is performing

Stay ahead on tax strategy and compliance with proactive support

Reach your finance team instantly in Slack and get answers in minutes — not weeks

Book your free strategy call and see how Haven can handle your books, reporting, and taxes — so you can stay focused on building your business.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026