Go Back

Last Updated :

Last Updated :

Nov 24, 2025

Nov 24, 2025

What Is Working Capital in Accounting? Extending Your Startup’s Cash Runway

As a founder or key operator in a startup or growing company, understanding what working capital is in accounting is essential to managing your business’s financial health and ensuring you have enough liquidity to keep operations running smoothly.

Working capital plays a critical role in how you manage cash flow, cover day-to-day expenses, and plan growth. In this guide, we’ll break down working capital in plain English, explore strategies to improve it, and share actionable tips for extending your cash runway so your startup can thrive.

What Is Working Capital in Accounting and Why It Matters for Startups

At its core, working capital measures the difference between your current assets and current liabilities on the balance sheet. Think of it as the cash and resources you have readily available to cover short-term obligations like payroll, supplier bills, rent, and operational expenses.

The Working Capital Formula

Working Capital Component | Definition | Why It Matters to Founders |

Current Assets | Cash, accounts receivable, inventory, and other assets convertible to cash within 12 months | This is your startup’s liquid or near-liquid resources. |

Current Liabilities | Accounts payable, short-term debt, accrued expenses, and other obligations payable in 12 months | The money you owe soon requires a cash outflow. |

Working Capital | Current Assets − Current Liabilities | Positive working capital = liquidity cushion; negative working capital may signal cash flow issues |

For startups, positive working capital means you have enough liquid resources to pay off short-term debts without dipping into long-term financing or capital raises. If your working capital is negative, you could face cash crunches that stall operational activities or growth initiatives.

Understanding this balance directly influences your financial planning — especially your cash runway, which is the amount of time your startup can operate before needing external funds. Knowing how to manage working capital effectively helps you sustain operations longer, bridge funding gaps, and negotiate better payment terms with suppliers or customers.

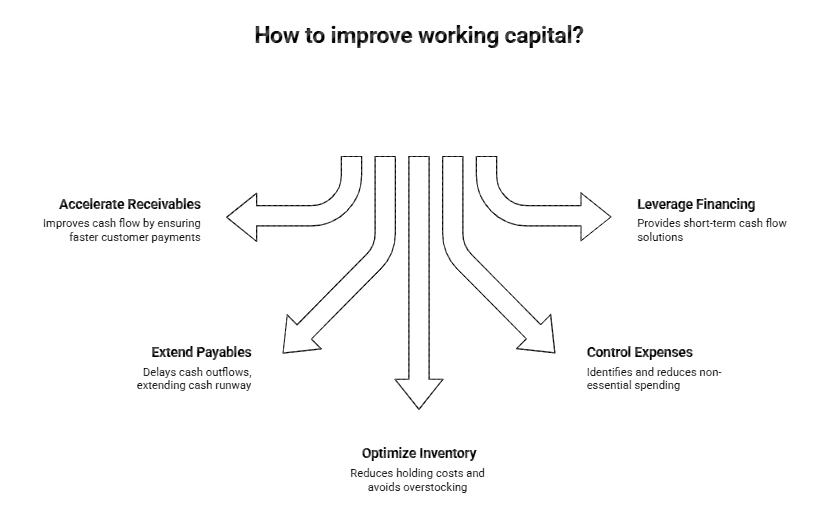

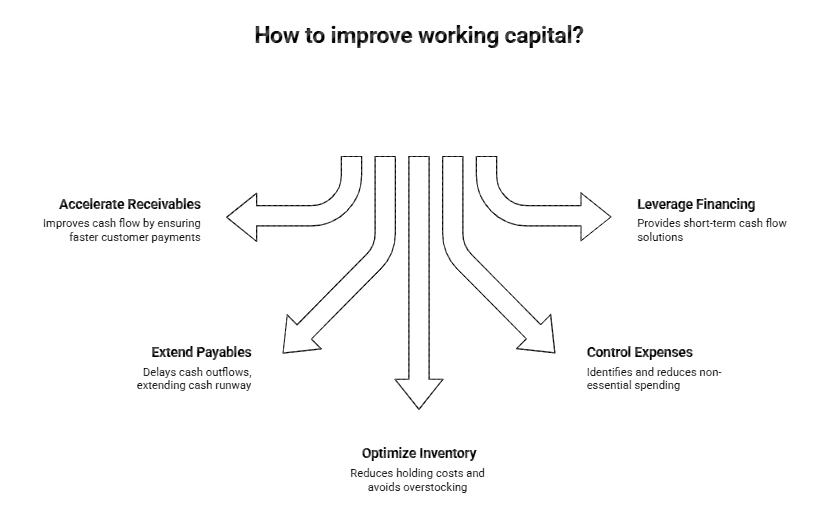

How Founders Can Improve Working Capital: Practical Steps to Extend Your Cash Runway

Improving working capital doesn’t have to mean raising capital immediately or drastically tightening expenses. Instead, founders can adopt tactical strategies focused on optimizing cash flow and operational efficiency. Here are some practical ways to improve your results:

Accelerate Accounts Receivable Collections

Improving how quickly your customers pay you can significantly boost your current assets.

Invoice promptly and clearly—ensure invoices are free from errors.

Offer early payment discounts to incentivize faster payments.

Use automated reminders and collection tools to reduce delays.

For recurring revenue, consider subscription billing to stabilize cash inflow.

Extend Accounts Payable Without Harming Supplier Relations

Maximizing your payment terms extends your cash runway by delaying cash outflows without jeopardizing valuable relationships.

Negotiate longer payment terms upfront, aiming for 45–60 days if possible.

Prioritize payments strategically — pay early to key suppliers, extend terms for others.

Avoid late payments that result in penalties or lost supplier trust.

Optimize Inventory Management

For startups dealing with physical inventory, managing stock levels affects working capital directly.

Align purchasing with sales forecasts to avoid overstocking.

Implement just-in-time procurement strategies to reduce holding costs.

Review slow-moving or obsolete inventory for potential write-offs.

Control Operating Expenses Smartly

Though cost-cutting should be strategic, some expenses can be deferred or managed better to protect working capital.

Audit expenses monthly to identify non-essential spend.

Leverage technology and automation to reduce labor costs.

Consider flexible staffing or outsourcing for non-core functions.

Leverage Short-Term Financing Strategically

Having access to a line of credit or short-term financing can smooth cash flow fluctuations but requires careful management.

Use revolving credit lines to cover temporary cash shortfalls.

Avoid over-reliance on debt, as interest and principal repayments reduce net working capital.

Evaluate financing costs against the benefit of a longer cash runway.

Why Working Capital Management Is Critical for Startup Success

Founders often focus on revenue growth and fundraising but can overlook the nuances of working capital in accounting, which can be a deciding factor in survival and scale. Here’s why working capital deserves your attention:

Cash Flow Stability

Even profitable startups face risks if cash inflows and outflows don’t align. Efficient working capital management stabilizes cash flow and reduces reliance on emergency measures.

Flexibility to Seize Opportunities

A healthy working capital position provides the agility to invest in marketing campaigns, hire talent, or develop new product features—without needing immediate capital raises.

Stronger Negotiating Position

With sufficient liquidity, founders can negotiate better terms with vendors, customers, and lenders.

Better Financial Reporting & Investor Confidence

Maintaining positive working capital and demonstrating sound cash flow management enhances your credibility with investors, lenders, and other stakeholders.

How Haven Supports Founders with Working Capital and Cash Flow Management

At Haven, we specialize in providing modern bookkeeping, tax filing, and R&D tax credit services designed to support startup founders and finance leaders. Our founder-friendly approach focuses on:

Real-time, transparent financials

Tax planning and filing

R&D tax credit expertise

Responsive support

Learn more about our tailored services here.

What Is Working Capital in Accounting — Your Key to Extending Runway

Understanding what working capital is in accounting is more than a bookkeeping exercise; it’s a practical, founder-focused tool for steering financial decisions with clarity. Strong working capital management helps you stay flexible, cover short-term obligations without stress, and keep your operations moving even when cash cycles shift or revenue becomes uneven.

If you're ready to take control of your financials and extend your cash runway, consider partnering with an expert who can help you optimize working capital, tighten operational efficiency, and build a clearer path to sustainable growth.

As a founder or key operator in a startup or growing company, understanding what working capital is in accounting is essential to managing your business’s financial health and ensuring you have enough liquidity to keep operations running smoothly.

Working capital plays a critical role in how you manage cash flow, cover day-to-day expenses, and plan growth. In this guide, we’ll break down working capital in plain English, explore strategies to improve it, and share actionable tips for extending your cash runway so your startup can thrive.

What Is Working Capital in Accounting and Why It Matters for Startups

At its core, working capital measures the difference between your current assets and current liabilities on the balance sheet. Think of it as the cash and resources you have readily available to cover short-term obligations like payroll, supplier bills, rent, and operational expenses.

The Working Capital Formula

Working Capital Component | Definition | Why It Matters to Founders |

Current Assets | Cash, accounts receivable, inventory, and other assets convertible to cash within 12 months | This is your startup’s liquid or near-liquid resources. |

Current Liabilities | Accounts payable, short-term debt, accrued expenses, and other obligations payable in 12 months | The money you owe soon requires a cash outflow. |

Working Capital | Current Assets − Current Liabilities | Positive working capital = liquidity cushion; negative working capital may signal cash flow issues |

For startups, positive working capital means you have enough liquid resources to pay off short-term debts without dipping into long-term financing or capital raises. If your working capital is negative, you could face cash crunches that stall operational activities or growth initiatives.

Understanding this balance directly influences your financial planning — especially your cash runway, which is the amount of time your startup can operate before needing external funds. Knowing how to manage working capital effectively helps you sustain operations longer, bridge funding gaps, and negotiate better payment terms with suppliers or customers.

How Founders Can Improve Working Capital: Practical Steps to Extend Your Cash Runway

Improving working capital doesn’t have to mean raising capital immediately or drastically tightening expenses. Instead, founders can adopt tactical strategies focused on optimizing cash flow and operational efficiency. Here are some practical ways to improve your results:

Accelerate Accounts Receivable Collections

Improving how quickly your customers pay you can significantly boost your current assets.

Invoice promptly and clearly—ensure invoices are free from errors.

Offer early payment discounts to incentivize faster payments.

Use automated reminders and collection tools to reduce delays.

For recurring revenue, consider subscription billing to stabilize cash inflow.

Extend Accounts Payable Without Harming Supplier Relations

Maximizing your payment terms extends your cash runway by delaying cash outflows without jeopardizing valuable relationships.

Negotiate longer payment terms upfront, aiming for 45–60 days if possible.

Prioritize payments strategically — pay early to key suppliers, extend terms for others.

Avoid late payments that result in penalties or lost supplier trust.

Optimize Inventory Management

For startups dealing with physical inventory, managing stock levels affects working capital directly.

Align purchasing with sales forecasts to avoid overstocking.

Implement just-in-time procurement strategies to reduce holding costs.

Review slow-moving or obsolete inventory for potential write-offs.

Control Operating Expenses Smartly

Though cost-cutting should be strategic, some expenses can be deferred or managed better to protect working capital.

Audit expenses monthly to identify non-essential spend.

Leverage technology and automation to reduce labor costs.

Consider flexible staffing or outsourcing for non-core functions.

Leverage Short-Term Financing Strategically

Having access to a line of credit or short-term financing can smooth cash flow fluctuations but requires careful management.

Use revolving credit lines to cover temporary cash shortfalls.

Avoid over-reliance on debt, as interest and principal repayments reduce net working capital.

Evaluate financing costs against the benefit of a longer cash runway.

Why Working Capital Management Is Critical for Startup Success

Founders often focus on revenue growth and fundraising but can overlook the nuances of working capital in accounting, which can be a deciding factor in survival and scale. Here’s why working capital deserves your attention:

Cash Flow Stability

Even profitable startups face risks if cash inflows and outflows don’t align. Efficient working capital management stabilizes cash flow and reduces reliance on emergency measures.

Flexibility to Seize Opportunities

A healthy working capital position provides the agility to invest in marketing campaigns, hire talent, or develop new product features—without needing immediate capital raises.

Stronger Negotiating Position

With sufficient liquidity, founders can negotiate better terms with vendors, customers, and lenders.

Better Financial Reporting & Investor Confidence

Maintaining positive working capital and demonstrating sound cash flow management enhances your credibility with investors, lenders, and other stakeholders.

How Haven Supports Founders with Working Capital and Cash Flow Management

At Haven, we specialize in providing modern bookkeeping, tax filing, and R&D tax credit services designed to support startup founders and finance leaders. Our founder-friendly approach focuses on:

Real-time, transparent financials

Tax planning and filing

R&D tax credit expertise

Responsive support

Learn more about our tailored services here.

What Is Working Capital in Accounting — Your Key to Extending Runway

Understanding what working capital is in accounting is more than a bookkeeping exercise; it’s a practical, founder-focused tool for steering financial decisions with clarity. Strong working capital management helps you stay flexible, cover short-term obligations without stress, and keep your operations moving even when cash cycles shift or revenue becomes uneven.

If you're ready to take control of your financials and extend your cash runway, consider partnering with an expert who can help you optimize working capital, tighten operational efficiency, and build a clearer path to sustainable growth.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026