Go Back

Last Updated :

Last Updated :

Nov 20, 2025

Nov 20, 2025

Bookkeeping for Content Creators: A Guide for Managing Your Income

Content creators earn across several channels—YouTube ads, sponsorships, merch, Patreon, brand deals, and platform payouts. Startups and agencies operating in the creator economy need bookkeeping that can track each income stream, handle variable expenses, and stay compliant with digital-specific tax rules. A streamlined system protects cash flow, improves tax planning, and keeps financials ready for scale.

This guide is built for founders and finance leads at US-based startups and agencies working with creators. It outlines practical bookkeeping strategies for multi-platform revenue, expense tracking, and tax readiness.

If you manage creator operations at scale, these workflows give you clear financial data so you can grow faster while keeping your team focused on producing content—not reconciling spreadsheets.

Understanding the Complexity of Multi-Platform Income

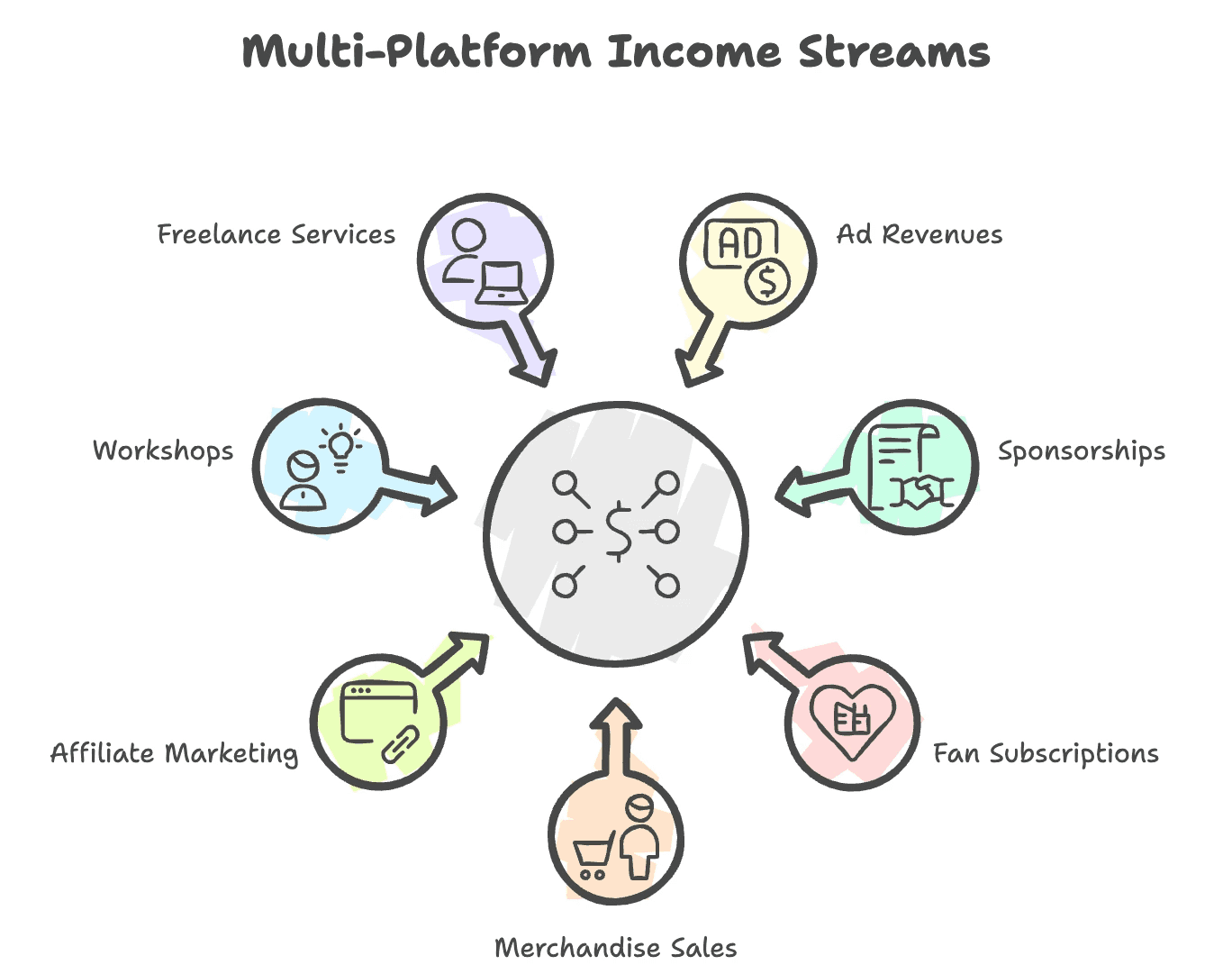

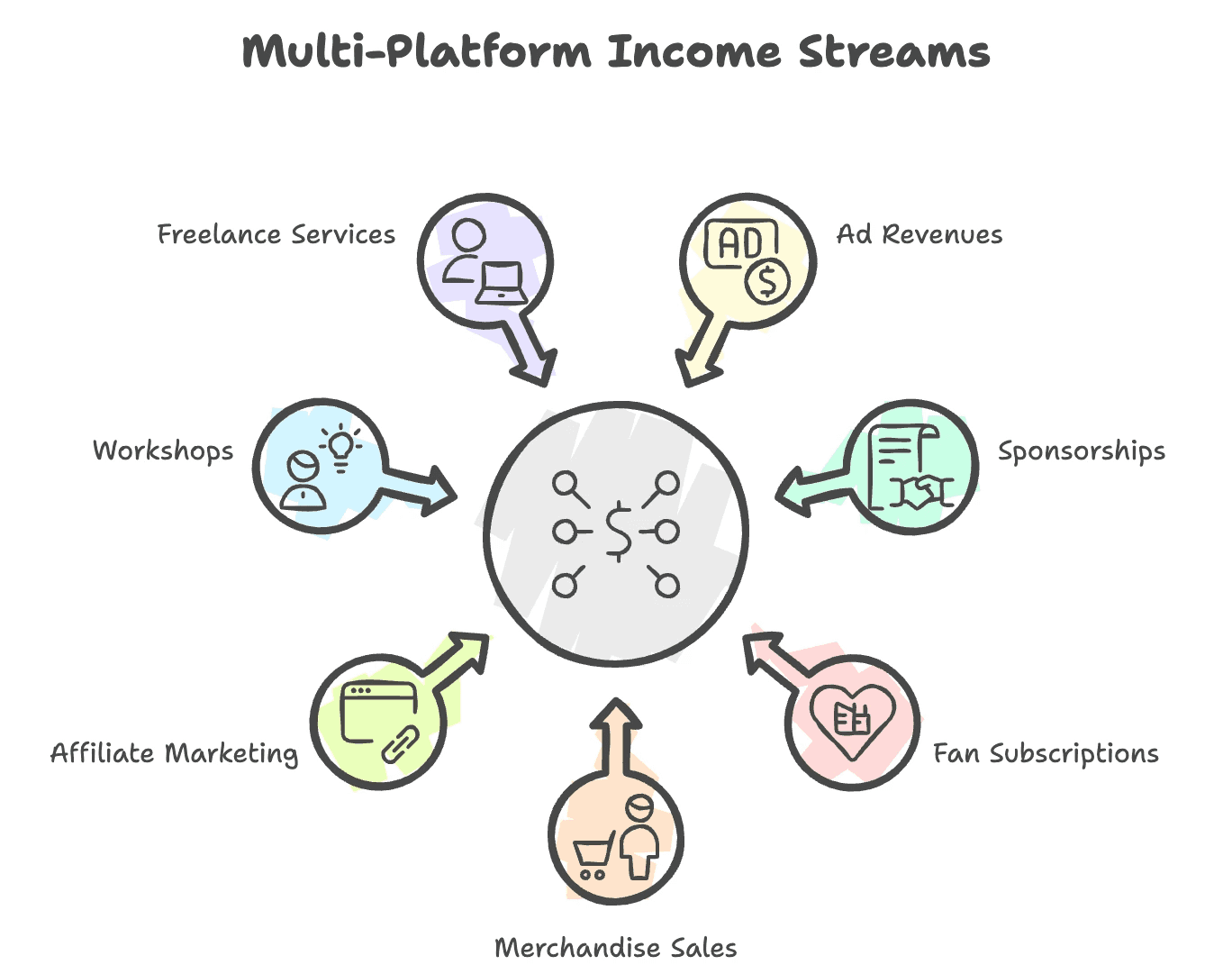

Content creators typically monetize in several ways simultaneously. Common streams include:

Ad revenues and platform payouts (YouTube, TikTok, Facebook)

Sponsorship deals and brand partnerships

Patreon and fan subscriptions

Merchandise and direct sales

Affiliate marketing commissions

Workshops or consulting income

Freelance content or production services

Startups and agencies managing these creator businesses face the dual challenge of:

Capturing income correctly and timely from disparate sources

Categorizing expenses and credits efficiently to optimize profitability and tax outcomes

Failing these often leads to mismatched books, missed tax deductions (such as software subscriptions, gear depreciation, or R&D tax credits), and frustrating reconciling at year-end.

One proactive step is leveraging dedicated bookkeeping services tailored for creators and startups. For example, Haven’s bookkeeping services provide modern tools and responsive support designed for founder-friendly financial management.

Best Practices in Bookkeeping for Content Creators

By adopting these best practices, founders can gain reliable financial insights while minimizing bookkeeping overhead:

Centralize Income Tracking with Automation

A key frustration is manually aggregating income across platforms each month. Instead, employ software that integrates with major platforms to import payments, invoices, and transaction data automatically. For example:

Connect your payment processors (PayPal, Stripe)

Sync ad revenue dashboards via API

Import sales data from e-commerce platforms

This automation ensures up-to-date records and reduces errors from manual data entry. Leveraging accounting software tailored for startups or creator-centric businesses allows tagging income streams by platform or revenue type.

For starters, explore digital bookkeeping tools recommended in bookkeeping best practices to find what fits your workflow.

Set Up Distinct Revenue Categories

Segment income streams within your bookkeeping system. This granularity enables the quick identification of top-performing platforms and clarifies cash flow sources for improved forecasting. Suggested revenue categories might be:

Revenue Category | Description |

Ad Revenue | Payments from platforms like YouTube or TikTok |

Sponsorship Income | Brand deals and partnerships |

Subscription Revenue | Monthly Patreon or membership income |

Merchandise Sales | Online store sales |

Affiliate Income | Commissions from affiliate programs |

Consulting or Workshops | Direct client work related to content creation |

Using these categories consistently furthers transparency, aids tax preparation, and supports data-driven decisions for scaling.

Track Expenses with Creator-Specific Tax Deductions in Mind

Many expenses can reduce taxable income if properly documented:

Equipment and gear (computers, cameras, microphones)

Software subscriptions (editing tools, project management)

Studio or office rent

Internet and phone bills

Travel for content production or events

Marketing and advertising expenses

Home office deduction, if applicable

Using detailed expense categories ensures founders do not miss these deductions. Additionally, advanced startups should assess whether qualifying for the Research & Development (R&D) Tax Credit is applicable, especially if their teams develop proprietary content technology or software. Haven’s expertise includes helping startups claim R&D credits that reduce tax burden and reinvest in growth.

Reconcile Income Monthly Against Platform Reports

Once income and expenses flow into your bookkeeping system, monthly reconciliation is critical. Compare your recorded income to platform statements or bank deposits to catch discrepancies early. This practice prevents significant surprises at tax time or when applying for capital.

Creative businesses often handle complex transactions, such as refunds, chargebacks, or platform fees, that must be carefully recorded in the ledger. Monthly reconciliation keeps financials clean and audit-ready.

Prepare Quarterly Estimated Tax Payments

Uneven cash flow is common for creators paid irregularly. To avoid penalties, founders must carefully estimate their quarterly income and tax liabilities. Accurate bookkeeping supports this with real-time visibility into earnings, deductions, and credits.

The Internal Revenue Service explains Estimated Tax Payments and Deadlines for self-employed individuals and businesses, including content creators navigating multi-stream income.

How Modern Bookkeeping Services Help Founders Scale Financially

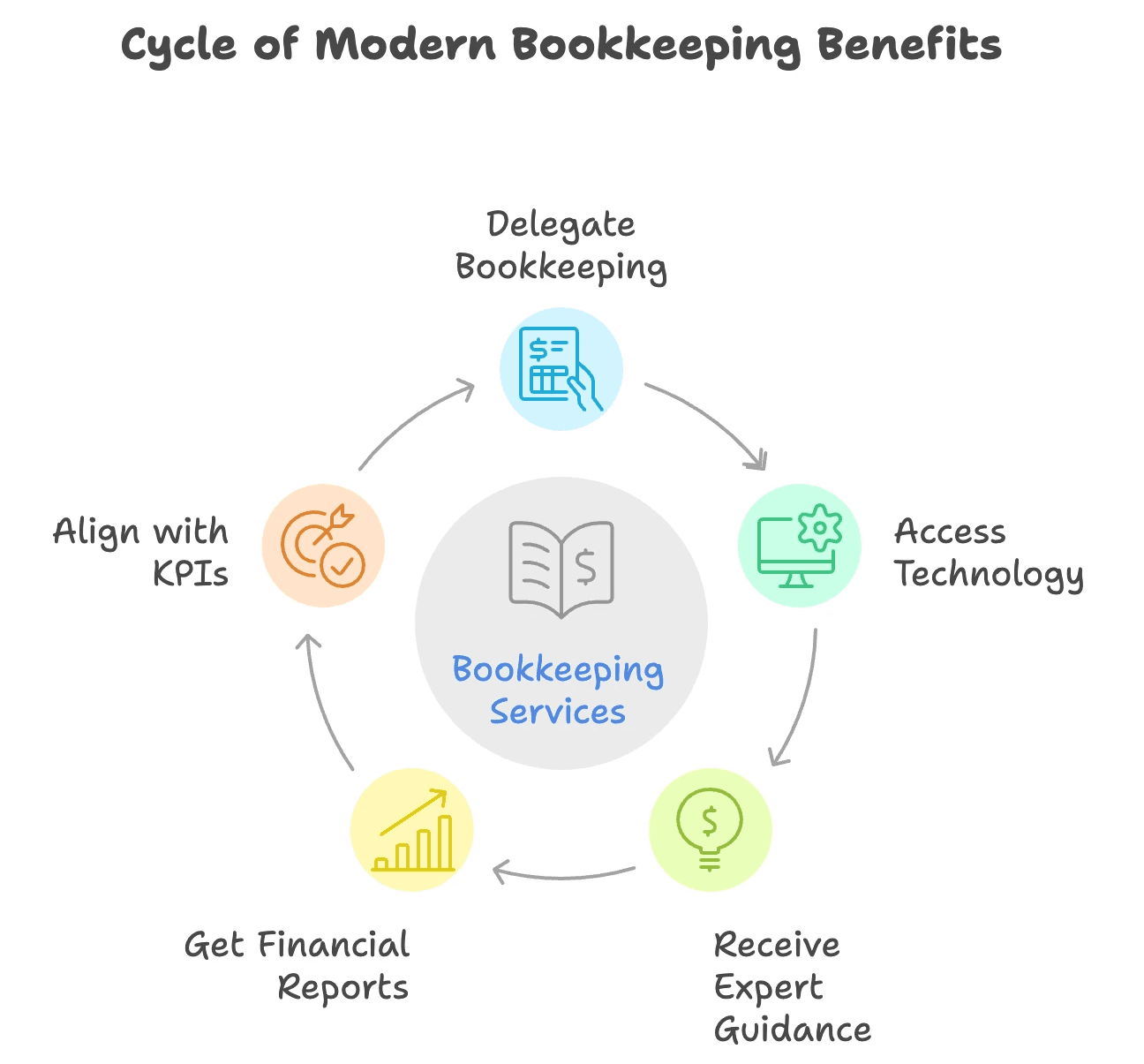

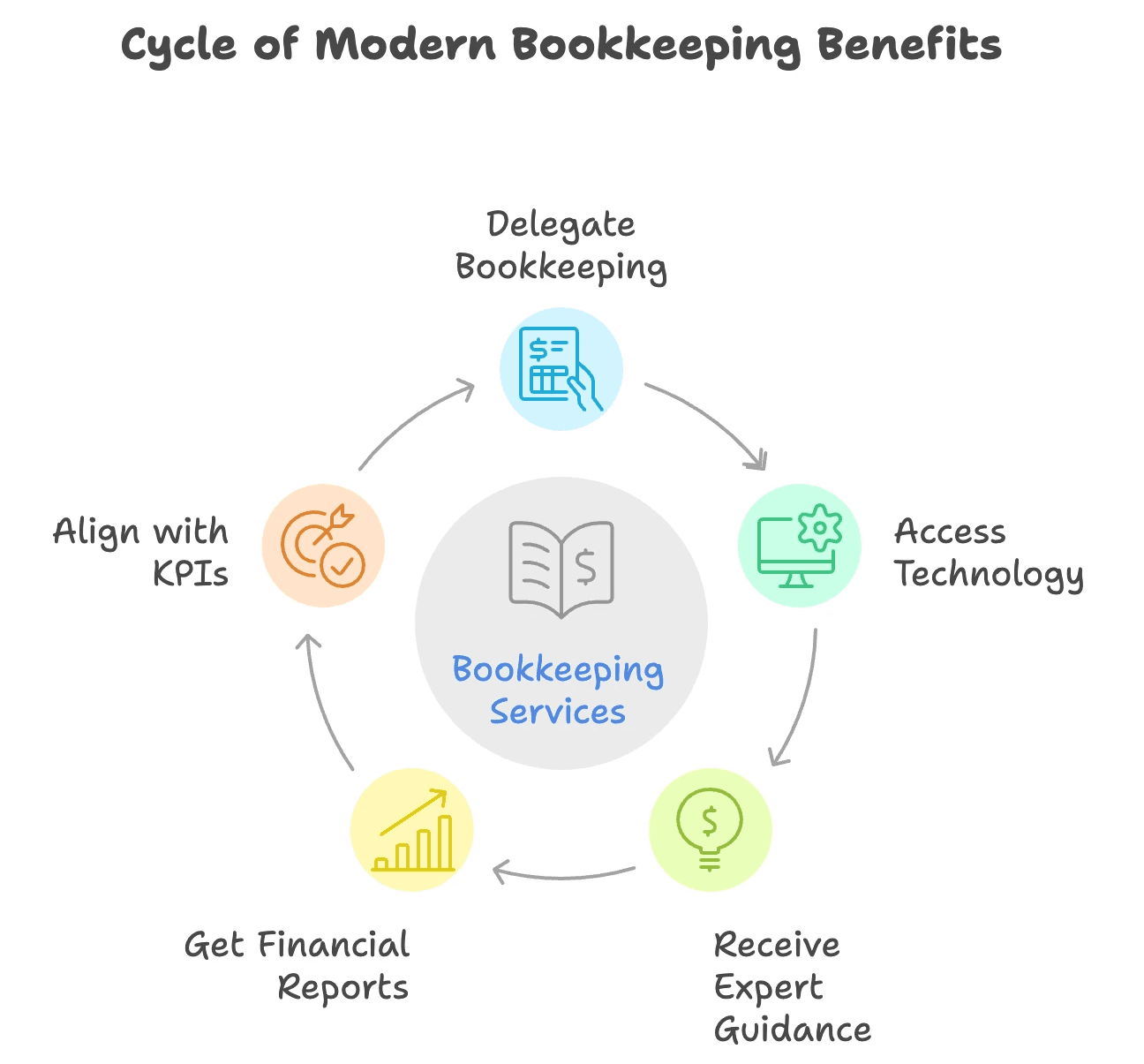

For growing creator businesses, DIY bookkeeping and manual spreadsheets introduce risk, inefficiency, and costly errors. Engaging responsive bookkeeping providers specializing in startups and digital content agencies allows founders to:

Delegate routine bookkeeping while maintaining control over financial insights

Access technology that integrates with common platforms and automates repetitive tasks

Receive expert guidance on tax optimization, including startup-specific credits like R&D

Get monthly financial reports actionable for decision-making and fundraising

Align bookkeeping with operational KPIs and cash flow forecasts

Haven delivers bookkeeping services purpose-built for startups and agencies selling products or services online, including content creators. By partnering with Haven, founder-CEOs can reduce administrative burden and sharpen financial precision.

Explore how founder-friendly approaches transform bookkeeping workflows at Haven’s bookkeeping services.

Content creators earn across several channels—YouTube ads, sponsorships, merch, Patreon, brand deals, and platform payouts. Startups and agencies operating in the creator economy need bookkeeping that can track each income stream, handle variable expenses, and stay compliant with digital-specific tax rules. A streamlined system protects cash flow, improves tax planning, and keeps financials ready for scale.

This guide is built for founders and finance leads at US-based startups and agencies working with creators. It outlines practical bookkeeping strategies for multi-platform revenue, expense tracking, and tax readiness.

If you manage creator operations at scale, these workflows give you clear financial data so you can grow faster while keeping your team focused on producing content—not reconciling spreadsheets.

Understanding the Complexity of Multi-Platform Income

Content creators typically monetize in several ways simultaneously. Common streams include:

Ad revenues and platform payouts (YouTube, TikTok, Facebook)

Sponsorship deals and brand partnerships

Patreon and fan subscriptions

Merchandise and direct sales

Affiliate marketing commissions

Workshops or consulting income

Freelance content or production services

Startups and agencies managing these creator businesses face the dual challenge of:

Capturing income correctly and timely from disparate sources

Categorizing expenses and credits efficiently to optimize profitability and tax outcomes

Failing these often leads to mismatched books, missed tax deductions (such as software subscriptions, gear depreciation, or R&D tax credits), and frustrating reconciling at year-end.

One proactive step is leveraging dedicated bookkeeping services tailored for creators and startups. For example, Haven’s bookkeeping services provide modern tools and responsive support designed for founder-friendly financial management.

Best Practices in Bookkeeping for Content Creators

By adopting these best practices, founders can gain reliable financial insights while minimizing bookkeeping overhead:

Centralize Income Tracking with Automation

A key frustration is manually aggregating income across platforms each month. Instead, employ software that integrates with major platforms to import payments, invoices, and transaction data automatically. For example:

Connect your payment processors (PayPal, Stripe)

Sync ad revenue dashboards via API

Import sales data from e-commerce platforms

This automation ensures up-to-date records and reduces errors from manual data entry. Leveraging accounting software tailored for startups or creator-centric businesses allows tagging income streams by platform or revenue type.

For starters, explore digital bookkeeping tools recommended in bookkeeping best practices to find what fits your workflow.

Set Up Distinct Revenue Categories

Segment income streams within your bookkeeping system. This granularity enables the quick identification of top-performing platforms and clarifies cash flow sources for improved forecasting. Suggested revenue categories might be:

Revenue Category | Description |

Ad Revenue | Payments from platforms like YouTube or TikTok |

Sponsorship Income | Brand deals and partnerships |

Subscription Revenue | Monthly Patreon or membership income |

Merchandise Sales | Online store sales |

Affiliate Income | Commissions from affiliate programs |

Consulting or Workshops | Direct client work related to content creation |

Using these categories consistently furthers transparency, aids tax preparation, and supports data-driven decisions for scaling.

Track Expenses with Creator-Specific Tax Deductions in Mind

Many expenses can reduce taxable income if properly documented:

Equipment and gear (computers, cameras, microphones)

Software subscriptions (editing tools, project management)

Studio or office rent

Internet and phone bills

Travel for content production or events

Marketing and advertising expenses

Home office deduction, if applicable

Using detailed expense categories ensures founders do not miss these deductions. Additionally, advanced startups should assess whether qualifying for the Research & Development (R&D) Tax Credit is applicable, especially if their teams develop proprietary content technology or software. Haven’s expertise includes helping startups claim R&D credits that reduce tax burden and reinvest in growth.

Reconcile Income Monthly Against Platform Reports

Once income and expenses flow into your bookkeeping system, monthly reconciliation is critical. Compare your recorded income to platform statements or bank deposits to catch discrepancies early. This practice prevents significant surprises at tax time or when applying for capital.

Creative businesses often handle complex transactions, such as refunds, chargebacks, or platform fees, that must be carefully recorded in the ledger. Monthly reconciliation keeps financials clean and audit-ready.

Prepare Quarterly Estimated Tax Payments

Uneven cash flow is common for creators paid irregularly. To avoid penalties, founders must carefully estimate their quarterly income and tax liabilities. Accurate bookkeeping supports this with real-time visibility into earnings, deductions, and credits.

The Internal Revenue Service explains Estimated Tax Payments and Deadlines for self-employed individuals and businesses, including content creators navigating multi-stream income.

How Modern Bookkeeping Services Help Founders Scale Financially

For growing creator businesses, DIY bookkeeping and manual spreadsheets introduce risk, inefficiency, and costly errors. Engaging responsive bookkeeping providers specializing in startups and digital content agencies allows founders to:

Delegate routine bookkeeping while maintaining control over financial insights

Access technology that integrates with common platforms and automates repetitive tasks

Receive expert guidance on tax optimization, including startup-specific credits like R&D

Get monthly financial reports actionable for decision-making and fundraising

Align bookkeeping with operational KPIs and cash flow forecasts

Haven delivers bookkeeping services purpose-built for startups and agencies selling products or services online, including content creators. By partnering with Haven, founder-CEOs can reduce administrative burden and sharpen financial precision.

Explore how founder-friendly approaches transform bookkeeping workflows at Haven’s bookkeeping services.

This article was co-written by:

Content

This article was co-written by:

2026

© Haven All Rights Reserved

2026

© Haven All Rights Reserved

2026